ABOUT US

Our Story, Strength, Solutions and Growth!

At General Credit Finance and Development Limited, we apply our strengths as a leading provider of loans and trade finance to deliver solutions, unlock value and propel growth. Our capital fuels the development of businesses and communities. Our strategic advice helps individuals and companies stabilize, grow and thrive during these challenging times. We invest in emerging markets and entrepreneurs that will be the wellsprings of future opportunity.

The solutions we provide reflect the insights generated by our diverse, global business platform, which encompasses private equity and real estate funds, hedge fund solutions, trade finance and independent advisory and restructuring practices. We have built the firm on a strong foundation of intellectual and financial capital. We focus on attracting exceptionally talented people and on creating an atmosphere that rewards initiative and independent thinking. Our solid financial base, including strong capital and liquidity, ensures our capacity to deliver on our commitments.

PHILOSOPHY

Each situation (and company) is unique. One-size-fits-all approaches will never help your business reach its full potential. Custom solutions take advantage of opportunities that your competitors can’t. That’s what we deliver to you.

What We Do?

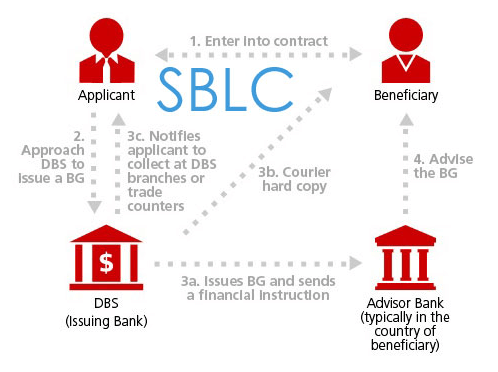

1. SBLC PROVIDER

SBLC – Standby Letter of Credit

A Standby Letter of Credit, also known as SBLC, refers to a legal instrument issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. It is a legal document that guarantees a bank’s commitment of payment to a seller in the event that the buyer—or the bank’s client—defaults on the agreement.

It is therefore a documentary guarantee, payable on first request, which is intended to secure the performance of a contract, obligation or flow of business transactions.

The SBLC should not be confused with the documentary credit which is instead a means of payment since the buyer goes to his bank and asks him to pay the seller at a given moment, ie on a date or to the fulfillment of a condition (delivery for example).

The lease and purchase of bank/financial instruments in form of Standby Letter of Credit popularly known as SBLC and Bank Guarantee popularly known as BG from us is achieved through what is referred to as “Transfer of collateral” or “Collateral transfer”.

2. BG- Bank Guarantee Providers

A guarantee means giving something as security. A bank guarantee is when a bank offers surety and guarantees for different business obligation on behalf of their customers within certain regulations. The lending institutions provide a bank guarantee which acts as a promises to cover the loss of the customer if he/she defaults on a loan. It is an assurance to a beneficiary that the financial institution will uphold the contract between the customer and third party if the customer is unable to do so.

Meaning of Bank Guarantee

A bank guarantee is a promise from a bank or other lending institution that if a particular borrower defaults on a loan, the bank will cover the loss. It is a kind of guarantee from a financing organization. The bank guarantee signifies a lending institution ensures that the liabilities of a debtor is going to be met. In other words, if the debtor is unsuccessful to settle a debt, the bank will cover it. A bank guarantee allows the customer, or debtor, to acquire goods, purchase equipment or draw down a loan.

Uses of Bank Guarantee

- When large companies purchases from small vendors, they generally require the vendors to provide guarantee certificate from banks before providing such business opportunities.

- Predominantly used in the purchase and sale of goods on credit basis, where the seller is assured of payment from the bank in case of default by the buyer.

- Helps in certifying the credibility of individuals, which in turn, enables them in obtaining loans and also assists in business activities.

Though there are lots of uses from a bank guarantee for the applicant, the bank should process the same only after ensuring the financial stability of the applicant/business. The risk involved in providing such a guarantee must be analysed thoroughly by the bank.

3. Monetization Of Bank Instruments

Bank Instruments Monetization simply involves converting a bank instrument (Bank Guarantee or Standby Letter of Credit) into liquid cash/legal tender mainly for purpose of project funding. The pre-exquisite for any bank instrument to be monetized remains that such Bank Guarantee (BG) or Standby Letter of Credit (SBLC) must be issued by a well-rated bank.

General Credit Finance and Development Limited are direct providers and monetizers of Bank Guarantees & Standby Letters of Credit

Certified Financial Instrument Providers of BG/SBLC MT760!

General Credit Finance and Development Limited are direct providers and monetizers of Bank Guarantees & Standby Letters of Credit.

Contact us today to see how a contractual BG/SBLC could help you close deals.