Email Us Now: info@gcfdl.com

How to Use SBLC for Loan Approval

Securing a loan can be challenging, especially when traditional collateral options are not viable. However, a Standby Letter of Credit (SBLC) can provide an alternative solution. This guide will walk you through how to use an SBLC for loan approval, its benefits, and the steps involved.

What is an SBLC?

A Standby Letter of Credit (SBLC) is a financial instrument issued by a #trusted SBLC provider like General Credit Finance and Development Limited (#GCFDL) that guarantees payment to a beneficiary if the applicant fails to meet their contractual obligations. It acts as a safety net for lenders, ensuring they receive payment even if the borrower defaults. Learn more about Standby Letter of Credit services by clicking here.

How to Get a Loan Approval Through SBLC

Using an SBLC to secure loan approval involves leveraging the guarantee provided by the bank. Here’s how to do it:

1. Understand the Lender’s Requirements: Before approaching a lender, understand their criteria for loan approval. Confirm that they accept SBLCs as collateral.

2. Obtain an SBLC from a Trusted Bank: Follow the steps outlined above to secure an SBLC. Ensure the issuing bank is credible and recognized by the lender.

3. Present the SBLC to the Lender: Submit the SBLC to the lender as part of your loan application. The lender will verify its authenticity and assess your overall financial profile.

4. Negotiate Loan Terms: With the SBLC in place, negotiate favorable loan terms with the lender. Highlight the reduced risk due to the bank’s guarantee.

5. Maintain Compliance: Adhere to the terms of the loan and the SBLC agreement. This ensures smooth transactions and builds trust with both the bank and the lender.

What is a Loan, Types, and Benefits?

A loan is a financial agreement where a lender provides funds to a borrower with the expectation of repayment over time, typically with interest. Loans are essential tools for individuals and businesses to achieve financial goals, such as purchasing property, expanding operations, or covering unexpected expenses.

There are various types of loans, including secured loans, which require collateral, and unsecured loans, which do not. Other common categories include personal loans, business loans, mortgages, auto loans, and student loans. Each type serves a specific purpose and comes with unique terms and conditions.

The benefits of loans are significant. They provide immediate access to funds, enabling borrowers to address financial needs or seize opportunities without delay. Loans also allow for flexible repayment terms, making it easier to manage large expenses over time. Additionally, responsibly managed loans can improve credit scores, enhancing future borrowing potential. For businesses, loans can fuel growth, support cash flow, and drive innovation. if you like to read more and know more about Loans, click here.

Why Use an SBLC for Loan Approval?

Using an SBLC for loan approval offers several advantages:

- Enhanced Credibility: An SBLC assures lenders of your financial reliability, increasing your chances of approval.

- Risk Mitigation: Lenders face reduced risk, as the issuing bank guarantees repayment.

- Flexibility: It’s a versatile tool suitable for various loan types, including business loans and project financing.

Step-by-Step Guide to Securing an SBLC from a Leading Provider

- Understand Your Loan Requirements: Identify the type and amount of loan you need. Ensure you meet the lender’s criteria and understand the terms of the loan.

- Approach a Trusted SBLC Provider – #GCFDL: Contact a reputable bank or financial institution like General Credit Finance and Development Limited that’s offering Standby Letter of Credit services. Provide required documentation, such as your business plan, financial statements, and credit history.

- Apply for the SBLC: Submit an application detailing the purpose of the SBLC and the loan it will support. The bank will assess your financial standing and request viability.

- Negotiate Terms and Fees: Discuss issuance and renewal fees with your bank to minimize costs.

- Submit the SBLC to the Lender: Present the SBLC as collateral. The lender will verify its authenticity and proceed with the loan approval process.

- Maintain Compliance: Adhere to the terms of both the SBLC and the loan agreement to avoid penalties or cancellation.

How ABC Corp Secured $2M Financing Using an SBLC

ABC Corp, a mid-sized manufacturing company, faced rejection from traditional lenders due to insufficient collateral. By obtaining an SBLC from General Credit Finance and Development Limited, they secured a $2M loan to expand operations. The SBLC provided assurance to us (the lender), resulting in loan approval within two weeks.

Client Testimonials

We secured a $26M loan for our startup using an SBLC from General Credit Finance and Development Limited (GCFDL). The process was seamless, and their trade finance specialist (Tang Wei) guided us every step of the way. I highly recommend them to anyone seeking an authentic SBLC provider with over 5 decades of history and credibility.” – T. Rogers, CEO of Startup Inc.

FAQs

What is an SBLC, and how does it work?

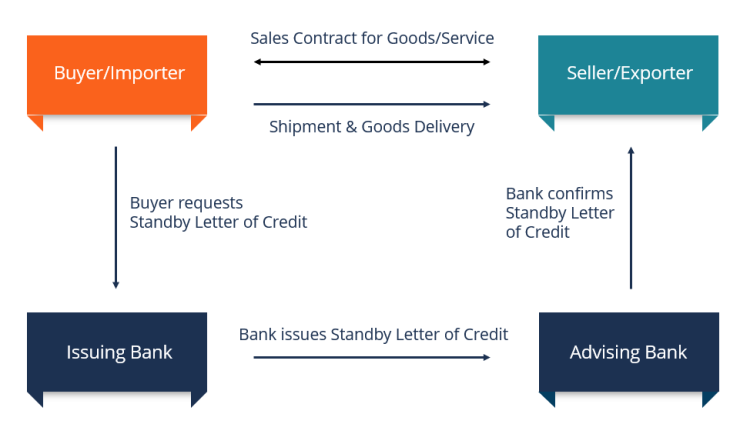

An SBLC (Standby Letter of Credit) is a financial instrument issued by a bank to guarantee payment to a beneficiary in case the applicant (buyer) fails to fulfill contractual obligations, such as payment or delivery. It is often used as a backup or “standby” assurance.

How does an SBLC work?

The issuing bank provides a written guarantee to the beneficiary that it will pay an agreed-upon amount if the applicant fails to meet the terms of the contract. The beneficiary can draw on the SBLC by presenting specific documents, typically a demand for payment and proof of default.

How much does it cost to get an SBLC?

Costs include issuance and renewal fees, which vary depending on the financing institution. However, at General Credit Finance and Development Limited, our SBLC issuing fee is 4% of the SBLC amount annually.

What are the common uses of an SBLC?

SBLCs are commonly used for:

- Securing international trade transactions.

- Providing credit enhancement for loans or investments.

- Facilitating project financing.

- Ensuring performance in contracts, such as construction projects or service agreements.

What types of SBLCs exist?

There are two main types:

- Performance SBLC: Guarantees non-monetary obligations, such as completing a project.

- Financial SBLC: Guarantees monetary obligations, such as payment for goods or services.

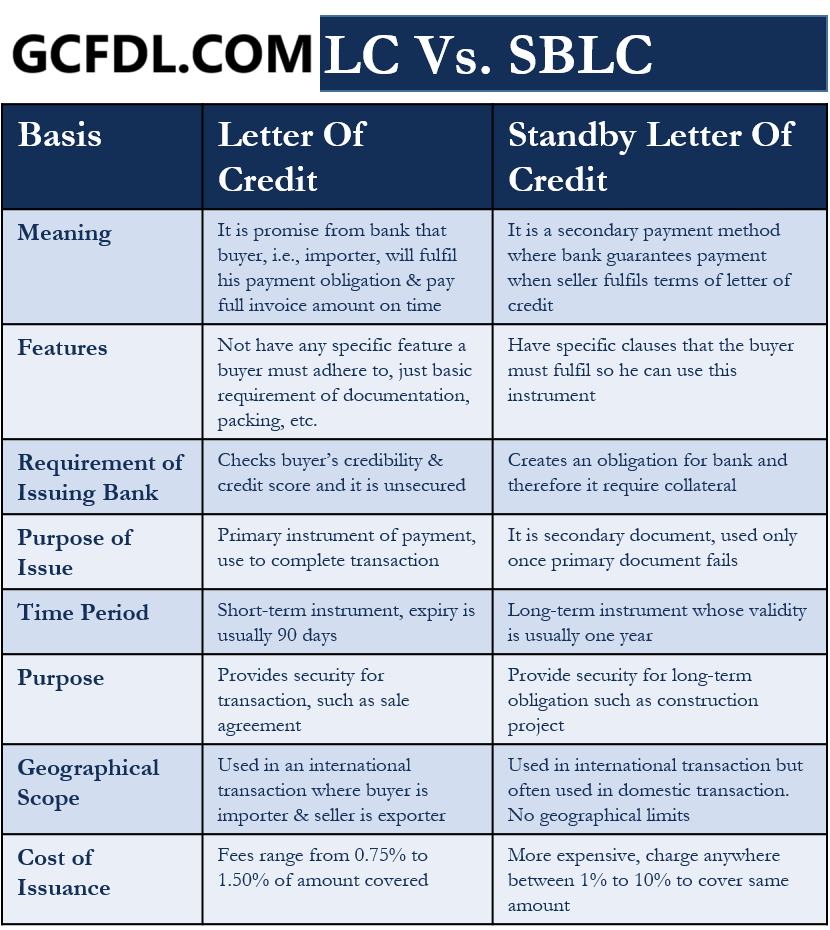

How is an SBLC different from a regular Letter of Credit (LC)?

While both are financial instruments, they differ in purpose:

- SBLC: Acts as a guarantee, triggered only in case of non-performance or default.

- LC: Facilitates payment by ensuring that funds are transferred once the terms of the trade are fulfilled.

What is the validity period of an SBLC?

The validity is determined by the terms of the contract and can range from a few months to several years. Banks usually prefer shorter periods, but extensions can be negotiated if needed.

Is an SBLC transferable?

Yes, some SBLCs can be transferable if explicitly stated in the terms. A transferable SBLC allows the original beneficiary to transfer part or all of the SBLC to a secondary beneficiary.

Can SBLCs be monetized?

Yes, SBLCs can be monetized. Beneficiaries often use SBLCs to secure financing from banks or investors by pledging the instrument as collateral.

Can an SBLC be used internationally?

Yes, SBLCs are recognized globally, making them ideal for international trade and financing.

How does the Uniform Customs and Practice (UCP 600) apply to SBLCs?

SBLCs are typically governed by the International Chamber of Commerce’s UCP 600 or ISP 98 (International Standby Practices), which standardize the rules and procedures for documentary credits and standby letters of credit.

Who are the parties involved in an SBLC?

The primary parties include:

- Applicant: The party requesting the SBLC (buyer).

- Beneficiary: The party in whose favor the SBLC is issued (seller).

- Issuing Bank: The bank providing the SBLC.

- Advising Bank (optional): A bank assisting in the transaction without assuming liability.

Who are SBLC Providers?

An SBLC provider is a financial institution like General Credit Finance and Development Limited (GCFDL) that issues SBLCs for customers. An SBLC provider must be licensed and authorized to provide financial services to customers. SBLC providers support businesses with business loans, credit enhancements, project financing, collateral transfer, and monetization services.

How to Get an SBLC

Obtaining an SBLC involves several steps that require careful planning and preparation:

- Identify Your Needs: Determine why you need an SBLC. Whether it’s for loan approval, business expansion, or securing a contract, understanding your purpose will guide the process.

- Choose a Reputable Bank: Research and select a bank with a strong reputation and experience in issuing SBLCs. Ensure the bank is recognized by your lender or business partner.

- Prepare the Required Documentation: Gather financial statements, business plans, credit history, and other relevant documents.

- Submit an Application: Apply for the SBLC through your chosen bank and provide all necessary documentation.

- Negotiate Terms: Discuss terms with your bank, including fees, validity period, and conditions for payment.

- Pay the Required Fees: Confirm all costs upfront to avoid surprises.

- Receive and Use the SBLC: Once issued, present the SBLC to your lender or business partner as a guarantee.

Using an SBLC for loan approval can be a game-changer, offering credibility and security in financial transactions. By understanding the process and working with reputable institutions, you can leverage this powerful tool to secure the funding you need.