Email Us Now: info@gcfdl.com

Understanding SBLCs/BGs

SBLCs/BGs Definition

SBLCs/BGs (Standby Letters of Credit and Bank Guarantees) are critical financial instruments widely used in international trade and large-scale projects to ensure contractual obligations are fulfilled. While they differ in purpose and application, both provide security and trust for parties involved in high-value transactions.

What is a Standby Letter of Credit (Sblc)?

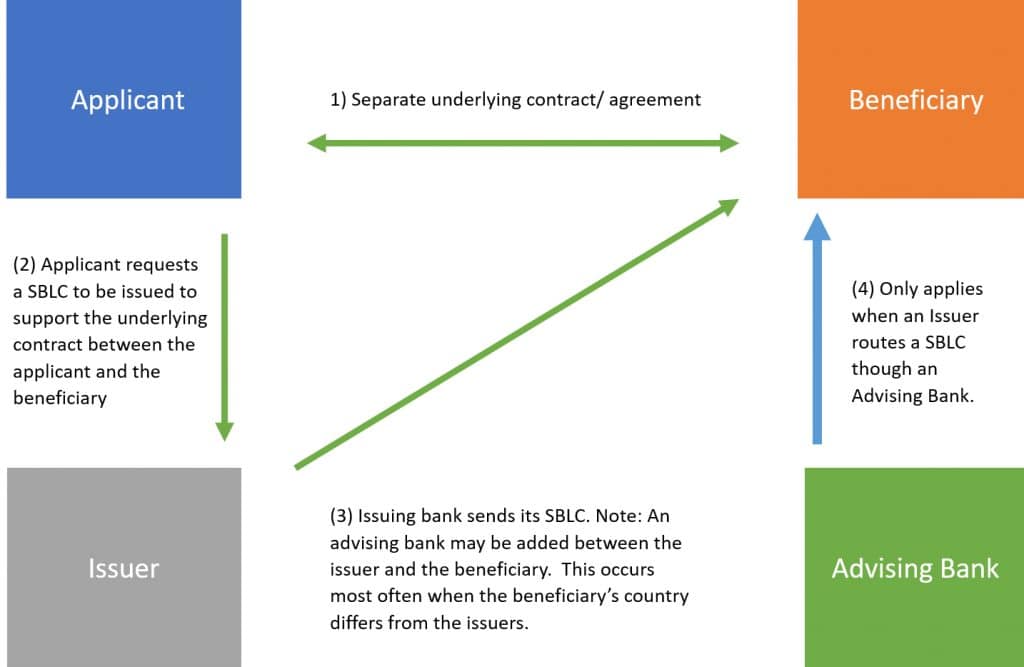

An SBLC is a commitment by a bank to pay a beneficiary if the applicant (its client) defaults on an agreed obligation. Often used in international trade, SBLCs ensure payment security, especially when the buyer and seller operate under different legal systems and lack prior business relationships.

Types of SBLCs Based on Function:

- Performance Standby: Ensures non-monetary obligations are met.

- Advance Payment Standby: Guarantees repayment of advance payments.

- Bid Bond/Tender Bond Standby: Ensures contract execution after a bid win.

- Financial Standby: Covers monetary obligations, such as loan repayments.

- Direct Pay Standby: Guarantees payment without default triggers.

- Insurance Standby: Backs insurance or reinsurance obligations.

- Commercial Standby: Ensures payment for goods or services.

Real-World Example: General Credit Finance and Development Limited (GCFDL) Securing a Trade Deal with an SBLC

A U.S.-based renewable energy company, SolarTech, wants to purchase $5 million worth of solar panels from a Chinese manufacturer, GreenPower Ltd. However, due to the lack of a prior trading relationship, GreenPower Ltd. requests financial assurance to mitigate risks.

SolarTech approaches General Credit Finance and Development Limited (GCFDL) to issue a Standby Letter of Credit (SBLC) to guarantee the payment to GreenPower Ltd.

The Step-by-Step Process:

Agreement and Request:

SolarTech and GreenPower Ltd. agree on the terms of the trade.

GreenPower Ltd. demands a financial guarantee before starting production.

SolarTech applies to General Credit Finance and Development Limited for an SBLC to back the $5 million transaction.

General Credit Finance and Development Limited assesses SolarTech’s financial stability, project viability, and collateral.

Upon approval, General Credit Finance and Development Limited prepares and issues the SBLC, guaranteeing payment if SolarTech defaults.

Issuance of SBLC:

General Credit Finance and Development Limited provides the SBLC to GreenPower Ltd. through their advising bank in China.

The SBLC assures GreenPower Ltd. that payment will be received once terms are met.

Shipment and Documentation:

GreenPower manufactures and ships the solar panels to SolarTech.

Required documents (e.g., bills of lading, certificates of inspection) are submitted to GCFDL.

Payment Fulfillment:

SolarTech pays GreenPower within the agreed period.

If SolarTech fails, GCFDL pays GreenPower as per the SBLC terms, ensuring GreenPower receives the full $5 million.

In the event of default, GCFDL recovers funds from SolarTech through the collateral or repayment arrangements.

Outcome:

GreenPower Ltd. feels secure in proceeding with production and shipment.

SolarTech secures the required solar panels, strengthening their renewable energy projects in the U.S.

GCFDL demonstrates its role as a trusted intermediary, earning a fee for issuing the SBLC and solidifying its reputation in international trade finance.

This example highlights how General Credit Finance and Development Limited (#GCFDL) leverages SBLCs to build trust and facilitate seamless cross-border transactions.

What is a Bank Guarantee (BG)?

A bank guarantee is a financial commitment provided by a bank on behalf of a client, ensuring that the client will meet their contractual obligations. If the client defaults, the bank steps in to fulfill the financial obligations to the beneficiary up to a specified amount. This instrument provides security and trust in transactions, especially those involving large sums or cross-border dealings.

BGs ensure that the liabilities of a borrower are met, making them crucial for transactions requiring performance or payment guarantees.

Types of Bank Guarantees:

Advance payment guarantee: The bank refunds the buyer’s advance payment if the seller doesn’t deliver the goods as per the contract.

Performance guarantee: The buyer is compensated for any loss if the seller doesn’t deliver goods or services that meet the contract’s minimum standards.

Payment guarantee: Covers the buyer’s obligation to pay for goods or services.

Tender guarantee: Also known as a bid bond, this guarantee provides a financial solution to the customer if the seller doesn’t fulfill the tender conditions.

Customs guarantee: A security of obligation for the company to pay customs taxes and duties to the customs authorities.

Warranty bond guarantee: Serves as collateral to ensure that the ordered goods are delivered as agreed.

Bank guarantees are a popular financial instrument to ensure proper performance of obligations. The type and terms of the guarantee are agreed between the parties of the contract and approved by the issuing bank.

Key Takeaways

A bank guarantee is a promise by a financial institution to meet the liabilities of a business or individual if they don’t fulfill their obligations in a contractual transaction.

Bank guarantees are largely used outside the U.S. and are similar to American standby letters of credit.

Bank guarantees are mostly seen in international business transactions, although they may also individuals may need a guarantee to rent property in some countries.

Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warrantee bond guarantee, and a rental guarantee.

Key Differences Between BGs and SBLCs

- Purpose:

- BG: Guarantees performance or payment.

- SBLC: Guarantees payment as a last resort.

- Usage Context:

- BG: Common in construction and project finance to ensure performance.

- SBLC: Primarily used in trade finance to mitigate payment risks.

- Parties Involved:

- BG: Typically involves two parties – applicant and beneficiary.

- SBLC: Involves three parties – applicant, issuing bank, and beneficiary.

- Payment Trigger:

- BG: Payment may occur even if obligations are ongoing.

- SBLC: Payment is made only if obligations are unmet.

SBLCs/BGs Monetization

Standby Letter of Credit (SBLC) and Bank Guarantee (BG) monetization is the conversion of a Standby Letter of Credit (SBLC) or bank guarantee into cash or legal tender mostly for project funding. SBLCs/BGs monetization, also known as SBLC/BG funding allows a business owner to obtain financing in the form of a nonrecourse loan. It allows the Standby Letter of Credit (SBLC) owner to access funds by leveraging the Standby Letter of Credit (SBLC) as collateral. This can be particularly useful for businesses needing liquidity without selling off assets.

Click here to read our Comprehensive Guide to Standby Letter of Credit (SBLC) Monetization

Leasing & Purchasing (Trading) SBLCs/BGs

Though primarily non-tradable, SBLCs and BGs can be traded in secondary markets. Here’s how the process works:

Origination: The issuing bank creates the instrument on its client’s behalf as a transaction guarantee. This is typically issued via SWIFT MT760.

Due Diligence: Rigorous verification ensures the instrument’s authenticity, often involving direct confirmation with the issuing bank.

Transfer Agreement: Once verified, the seller and buyer of the instrument execute a transfer agreement detailing terms such as pricing and transfer methods.

Payment and Transfer: The issuing bank updates records to reflect the new beneficiary after the buyer makes payment.

Investment banks and Financial institutions like General Credit Finance and Development Limited facilitate these transactions, requiring the instruments to be issued with ISINs to enhance traceability. However, this market is highly niche, lightly regulated, and prone to risks, making expert guidance by General Credit Finance and Development Limited (GCFDL) essential. #GCFDL is recognized as the most reliable provider of bank instruments as well as a BG/SBLC issuer and monetizer, boasting over 50 years of unparalleled history of trust and credibility.

The Role of ISP98 in SBLCs/BGs

The International Standby Practices (ISP98), issued by the International Chamber of Commerce (ICC), governs SBLCs. These rules provide clear guidance on issuing, interpreting, and managing SBLCs, ensuring uniformity across international markets.By including the clause “This undertaking is subject to the International Standby Practices 1998,” parties align their SBLCs with internationally recognized practices, enhancing legal and operational clarity.

SBLCs/BGs Providers

Standby Letter of Credit (SBLC) and Bank Guarantee (BG) Providers: Who Are They?

SBLCs and BGs are essential financial instruments that enable businesses to secure transactions and mitigate risks in international trade, large-scale projects, and financing arrangements. These instruments are provided by various entities, including banks, and financial institutions like General Credit Finance and Development Limited (GCFDL). Here’s a breakdown of who they are and what they do:

1. Banks: Banks are the primary providers of SBLCs/BGs, as these instruments fall within their core services.

Issuing Banks: Banks that directly issue SBLCs/BGs on behalf of their clients, are usually large, reputable commercial banks or investment banks, such as HSBC, JP Morgan Chase, Citibank, or Barclays.

2. Non-Banking Financial Institutions (NBFIs): Some financial institutions, other than traditional banks, specialize in issuing guarantees or facilitating trade finance for businesses.

Export Credit Agencies (ECAs): Government-backed institutions, such as Export-Import (EXIM) banks or ECAs, often issue SBLCs/BGs to support exports and economic development.

Private Financial Institutions: Specialized firms that provide SBLCs/BGs for businesses with specific needs, often in niche markets.

3. Investment Banks: Investment banks often facilitate SBLCs and BGs for high-value transactions, mergers, acquisitions, or infrastructure projects. They may structure these instruments with additional features, such as ISINs, to make them tradable in secondary markets.

4. Government-Backed Institutions: Certain government agencies provide SBLCs/BGs to support national companies involved in international trade or large-scale infrastructure projects. Examples include institutions like the U.S. Export-Import Bank, UK Export Finance, and Germany’s Euler Hermes.

5. Licensed Money Lenders / Financial Institutions: Government licensed money lenders such as General Credit Finance and Development Limited (GCFDL) provide loans, project finance, bank guarantees, and standby letters of credit to businesses.

Things To Consider When Choosing a Bank Instrument (SBLC/BG) Provider

Reputation and Credibility: Always select a provider with a solid reputation and proven track record. Verifying the issuing bank or institution’s credibility is crucial.

Costs and Fees: BG/SBLC Providers charge fees for issuing SBLCs or BGs, typically as a percentage of the guaranteed amount. Compare rates and terms before committing. At General Credit Finance and Development Limited, our BG/SBLC annual leasing fee is just 4%.

Regulatory Compliance: Ensure your BG/SBLC provider adheres to international guidelines like ISP98 (for SBLCs) or URDG (for BGs).

Standby Letter of Credit and Bank Guarantee providers are financial institutions such as General Credit Finance and Development Limited by our bank (as the provider) to the beneficiary’s account/bank and it is transmitted interbank only through SWIFT (MT760). During the lifespan of the instrument, the beneficiary may utilize it for the two main and popular purpose of credit enhancement (raise loan, enhance credit line) or as a payment guarantee (Trade positions of a buy and sell contract for good and/or services to be rendered).

At the end of the tenure of the agreement that guided the issuance, the beneficiary is expected to return the SBLC / bank guarantee without encumbrances or liens and the beneficiary also has the obligation to indemnify us against any loss incurred against such instrument. In addition, the beneficiary also has the option of extending the contract because our collateral transfer agreement or Deed of agreement always comes with an option of rolls and extension of up to 5 years and in some cases 10 years depending on how strong the beneficiary is placed and our due diligence.

Our Bank Guarantee and Standby Letter of Credit is issued from AAA rated banks only and it is widely accepted in all banks in the world with some exception that we may not be willing to send out a SWIFT to some banks/financial institutions based on our previous experience and relationship with such bank/institutions.

There is always an option for the applicant/beneficiary to submit their verbiage for review depending on the approval of our bank otherwise, our bank’s standard verbiage will be used in SWIFT transmission of such bank instrument which will be made available in the contract which is usually in the ICC758 (UPC 600) format which is widely accepted for activation of the credit line.

Our contract fee is charged at a rate of 4% annual leasing fee and there are variables that determine this which all falls on our due diligence on the beneficiary/receiver and obviously, the contract size also has an effect on the pricing.

How Much Does SBLCs/BGs Cost?

Typically, SBLC fees vary between 1% and 10% of the total face value for each year that the SBLC is active. At General Credit Finance and Development Limited, our BG/SBLC leasing fee is just 4% of the face value per annum. And the best part, you do not need collateral to qualify. We have solutions for every customer in every industry.

When Do You Need SBLCs/BGs?

Standby letters of credit are frequently used in international and domestic transactions where the parties to a contract do not know each other. The SBLC is used when a buyer needs to guarantee payment for goods or services, or when a seller wants to protect themselves from a buyer who may not pay.

International trade: SBLCs are often used in international trade deals, especially when the parties involved don’t know each other or the terms of the agreement are different.

Payment protection: SBLCs provide a safety net for the seller by ensuring that the bank will pay for the goods or services if the buyer defaults or doesn’t pay.

Credit rating: A seller may request an SBLC if they don’t think the buyer’s credit rating is good enough.

Supply contracts: SBLCs are used to support regular supply contracts with exporters.

Where Can I Apply for a Standby Letter of Credit?

Standby letters of credit are typically offered by commercial banks and government-licensed financial institutions like General Credit Finance and Development Limited. The bank or financial institution will assess the creditworthiness of the applicant much like a loan application.

Why Choose General Credit Finance and Development Limited as your SBLC/BG Provider?

Experience: Over fifty-one years of expertise in facilitating BG and SBLC transactions.

Reliability: Transparent processes and adherence to international financial standards.

Custom Solutions: Tailored financial instruments to meet your business needs.

Global Network: Partnerships with top banks and financial institutions.

Efficient Processes: From documentation to SWIFT transmission, we ensure a smooth and timely experience.

How to Get Started with SBLCs/BGs

If you’re interested in securing a Loan, Trade Finance, Bank Guarantee, Standby Letter of Credit, or other financial instruments, General Credit Finance and Development Limited is here to help. We make the process straightforward and hassle-free, ensuring that the financial instrument (LC, DLC, BG or SBLC) is issued from prime AAA rated banks such as Citibank NYC, Standard Chartered Bank Singapore, HSBC Hong Kong, Barclays Bank London or any prime bank of choice.

🚀 Secure your SBLC or Bank Guarantee today!

📩 Contact our trade finance experts now:

🌐 Website: www.gcfdl.com

📧 Email: info@gcfdl.com

Related Readings

General Credit Finance and Development Limited is a Licensed Money Lender that was incorporated in Hong Kong on APRIL 03, 1973 with company registration number 0032754.

Our website blog is a free university that can transform anyone into a world-class financial analyst. If you enjoyed this article, please share it so others can read it too.

To keep learning and developing your knowledge of global trade and finance, we highly recommend the additional resources below:

- What is a Standby Letter of Credit (SBLC/SLOC)?

- Bank Guarantees vs. Standby Letters of Credit

- International Bank Guarantee Providers

- Bank Instruments Definition, Types & Uses

BusinessLoan #BGSBLCMonetization #StandbyLetterOfCredit #BankGuarantee #Financialinstruments #GeneralCreditFinanceAndDevelopment

[…] a Commercial LC, an SBLC serves as a safety net rather than a direct payment tool. It only comes into effect if the buyer […]