Email Us Now: info@gcfdl.com

Standby Letter of Credit (SBLC) Monetization

A Comprehensive Guide to Standby Letter of Credit (SBLC) Monetization: Unlocking Financial Potential

In the constantly changing world of global finance, SBLC monetization has become an essential tool for businesses looking to access immediate liquidity from financial instruments. At General Credit Finance and Development Limited, a Hong Kong-based financial institution that specializes in loans, project finance, trade finance, and the issuance and monetization of SBLCs, we enable businesses worldwide to effectively utilize their financial instruments.

This article explores the concept of SBLC monetization, including its process, benefits, and real-world examples.

What Is an SBLC?

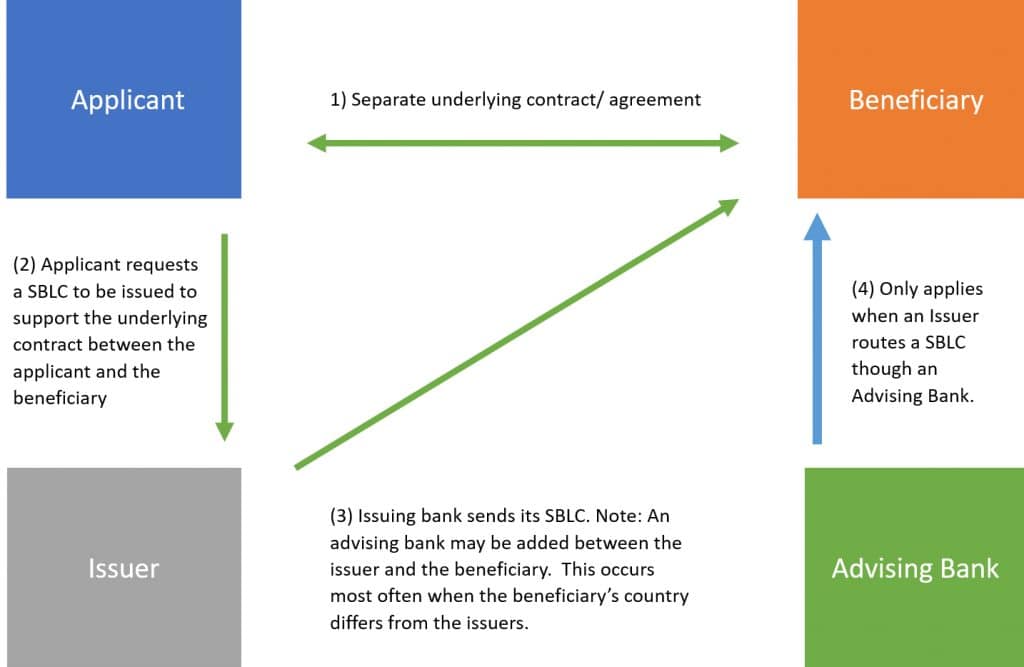

A standby letter of credit (SBLC) is a legal document issued by a bank on behalf of its client, providing a guarantee of its commitment to pay the seller if its client (the buyer) defaults on the agreement. A standby letter of credit helps facilitate international trade between companies that don’t know each other and have different laws and regulations.Click here to read our comprehensive article on standby letters of credit (SBLC).

Key Takeaways

- A Standby Letter of Credit (SBLC) provides reassurance to the other party during a business transaction.

- The SLOC guarantees that a bank will financially back the buyer in the event that they can’t complete their sales agreement.

- SBLCs are commonly used in domestic and international transactions where the parties to a contract do not know each other.

- A standby letter of credit acts as a safety net by ensuring the seller that the bank will make payment for goods or services delivered if the buyer defaults on their payment.

Types of Standby Letter of Credit

1. Financial SBLC: The financial-based SBLC guarantees payment for goods or services, as stipulated in the agreement. For example, if a crude oil company ships oil to a foreign buyer expecting payment within 30 days of shipment, and the buyer fails to make the payment by the due date, the crude oil seller can collect the payment for the delivered goods from the buyer’s bank. Since this arrangement involves credit, the bank will collect the principal amount along with any interest from the buyer.

2. Performance SBLC: A performance-based Standby Letter of Credit (SBLC) guarantees that a project will be completed within the agreed timeline. If the bank’s client fails to complete the project as outlined in the contract, the bank commits to reimbursing the third party involved in the contract a specified amount of money.

Performance SBLCs are commonly used in projects with strict deadlines, such as construction projects. This payment acts as a penalty for any delays in the project’s completion and serves to compensate the customer for the inconvenience caused. It may also be used to hire another contractor to take over the project.

Cost of Standby Letter of Credit (SBLC)

At General Credit Finance and Development Limited, our bank guarantee (BG) and Standby Letter of Credit (SBLC) leasing fee is 4% per year. If the BG or SBLC is needed for more than one year, the contract will include options for rolls and extensions where applicable. If the terms of the contract are fulfilled early, the customer can cancel the BG or SBLC without incurring any additional charges.

Leased Bank Instruments (BG/SBLC) Description:

1. Instrument Type: Fully Cash Backed Bank Guarantee {BG} / Standby Letter of Credit {SBLC}

2. Total Face Value: USD 2Million (Min) to USD 5B (Max)

3. Issuing Bank: Citibank, HSBC Hong Kong, Barclays Bank London or any AAA rated European/American bank.

4. Age: One Year and One Day (with rolls and extensions where applicable)

5. Leasing Price: 4% (+2% broker’s commission where applicable) A 2% commission applies to clients introduced by brokers.

6. Delivery: SWIFT MT-760

7. Payment: MT103 Wire Transfer8. Bank Transmission fee: This varies and depends on the BG/SBLC face value.

9. Hard Copy: Bonded Courier within 7 banking days.

How to Obtain a Standby Letter of Credit

The process of obtaining a standby letter of credit (SBLC) is similar to securing a business loan, but there are some key differences.

Like any business loan, you must demonstrate your creditworthiness to the bank. However, the approval process for an SBLC is much faster, with letters typically being issued within a week after all necessary paperwork has been submitted.

At General Credit Finance and Development Limited (GCFDL), we excel in the issuance, leasing, funding, and monetization of bank instruments. For us, reaching the finish line is what truly matters.

What Is SBLC Monetization?

SBLC monetization is the process of liquidating/converting an SBLC into liquid funds, typically through a financial institution or monetizer. This enables businesses to access much-needed capital for operational, investment, or project financing. It is a low cost, low-risk method of trade finance that converts financial instruments into cash or cash equivalents.

But the Standby Letter of Credit (SBLC) must be issued by a reputable European or American bank, such as Deutsche Bank, Citibank, JP Morgan, HSBC, or Barclays Bank. This is very important because SBLCs from banks that are not rated have little to no value, making them difficult to monetize.

Furthermore, the SBLC must contain the correct wording and verbiage. Whether the SBLC is leased or purchased is not as important as the credibility of the issuing bank and the accuracy of the language/verbiage used. For expert guidance, it’s advisable to consult the trade finance specialists at General Credit Finance and Development Limited.

Bank Guarantee / SBLC Monetization Process

As industry leaders, we utilize both The Swift and Euroclear networks to monetize financial instruments.

Swift Network System: We utilize the Bank SWIFT Network to deliver the instrument directly from one bank to another using the SWIFT codes MT799 and MT760.

Euroclear Network: We use the Euroclear Network due to its fast and transparent settlement process. By using the Free Euroclear Delivery method, clients do not face any Swift charges or delays. Euroclear is a reputable financial transaction settlement network in Europe, founded in 1968 by JP Morgan, and it continues to operate successfully.

- Issuance of the SBLC: A credible financial institution issues the SBLC on behalf of the client.

- Submission to the Monetizer: The SBLC is presented to the monetizer for verification.

- Verification and Compliance: The monetizer conducts due diligence to confirm the SBLC’s authenticity.

- Repayment Terms: Terms of repayment or fees are established, depending on the monetization agreement.

- Agreement and Monetization: Upon approval, the monetizer disburses the agreed percentage of the SBLC’s face value as cash.

Case Study: General Credit Finance and Development Limited Facilitates SBLC Monetization

A Hong Kong-based trading company approached General Credit Finance and Development Limited to monetize a $10 million SBLC issued by Barclays bank London. Facing cash flow challenges during a crucial trading cycle, the company required immediate funds.

Solution Provided:

- Issuance: The client’s bank issued the SBLC with General Credit Finance as the beneficiary.

- Monetization: We verified and monetized the SBLC within ten days, providing the client with $8 million in liquid funds (80% of the face value).

- Outcome: The client successfully completed their trade transaction and repaid the monetized amount as agreed.

Key Considerations for SBLC Monetization

- Reputable Issuers: Always work with banks that have a strong credit rating. Avoid unrated Asian / African banks.

- Monetizer Credibility: Ensure the monetizer has a proven track record and transparent processes.

- Costs and Fees: Understand the terms, including fees, percentages, and hidden charges if any.

- Purpose: You must have a qualifying project to participate in BG/SBLC monetization.

- Industry Expertise: Work with an institution that has the capacity to issue and monetize SBLC in-house without involving third parties. Most BG/SBLC issuance and monetization transactions fail because different parties are involved in the transaction. General Credit Finance and Development Limited is the only monetizer of BGs and SBLCs that issues and monetizes bank instruments in-house without involving a third party in the transaction. This is why we have never experienced any failed transactions.

Risks Associated with BG/SBLC Monetization

- Fraudulent SBLCs: Verify the SBLC’s authenticity through secure channels or contact us to help you verify if your SBLC is real or fake.

- High Fees: Work with transparent monetizers to avoid excessive costs and hidden charges.

- Mismanagement of Funds: Ensure the funds are strategically used to finance the intended project.

Frequently Asked Questions

What is the typical monetization percentage?

Most monetizers offer 60-80% of the instruments face value, depending on the issuer’s credibility. At General Credit Finance and Development Limited, our monetization rate is 80% LTV.

How long does the process take?

Typically, SBLC monetization can take between 5-10 business days, depending on several factors, including issuing bank, client projects, due diligence etc. At General Credit Finance and Development Limited (GCFDL), we can issue and monetize a financial instrument within 14 days max.

Why Choose General Credit Finance and Development Limited?

General Credit Finance and Development Limited is a Licensed Financial Services Provider (FSP) that was incorporated in Hong Kong on APRIL 03, 1973 with company registration number 0032754.

Since our incorporation in 1973, we’ve been the trusted choice for businesses across the globe, offering tailored financial solutions such as Business Loans, SME Loans, Collateral Transfer, Bank Financial Instruments, Standby Letters of Credit (SBLC) and Bank Guarantees (BG) issuance and monetization services. Whether you need a recourse or non-recourse loan, international project financing, or trade finance, to activate credit lines, monetize financial instruments, or secure a bank guarantee/letters of credit for international trade, we have the expertise and global connections to make it happen.

We provide loans for all industries and sectors at a competitive interest rate of 3% per annum and welcome clients from all races, cultures, and nationalities without discrimination. If your business or project is profitable and viable, we will provide the funds you need to take your business to the next level.

All our bank instruments (BG, LC, SBLC, etc.) are issued from top-rated banks such as Citibank New York, Chase Bank, Wells Fargo, Bank of America, HSBC, Barclays Bank London, Standard Chartered Bank, UBS Switzerland, Deutsche Bank AG Germany, etc. Our annual leasing fee for Bank Guarantees (BG) and Standby Letters of Credit (SBLC) is 4%.

Conclusion

SBLC monetization is a powerful financial tool for businesses aiming to secure liquidity without overextending their credit. By partnering with reputable institutions like General Credit Finance and Development Limited, you can ensure a seamless and transparent process, helping you achieve your financial objectives.

Website: https://www.gcfdl.com || Email: info@gcfdl.com

Our website blog is a free university that can transform anyone into a world-class financial analyst. If you enjoyed this article, please share it so others can read it too.

To keep learning and developing your knowledge of global trade and finance, we highly recommend the additional resources below:

- Understanding Trade Finance: Tools and Strategies to Mitigate International Trade Risks

- Guide On How To Spot Genuine SBLC Providers

- Bank Instruments Definition, Types & Uses

- The Advantages of Standby Letters of Credit (SBLC) for Businesses in Financing

#SBLCMonetization #StandbyLetterOfCredit #BankGuarantee #Financialinstruments #GeneralCreditFinanceAndDevelopment

[…] personal loans, business loans, Recourse Loans, Non-recourse Loans, bank instruments, Lease SBLC, Monetize SBLC, Lease bank Guarantees & the Monetization of bank instruments etc. whether you’re looking to […]