Bid Bond- Tender / Counter Guarantee

Tender Guarantee / Counter-Guarantee

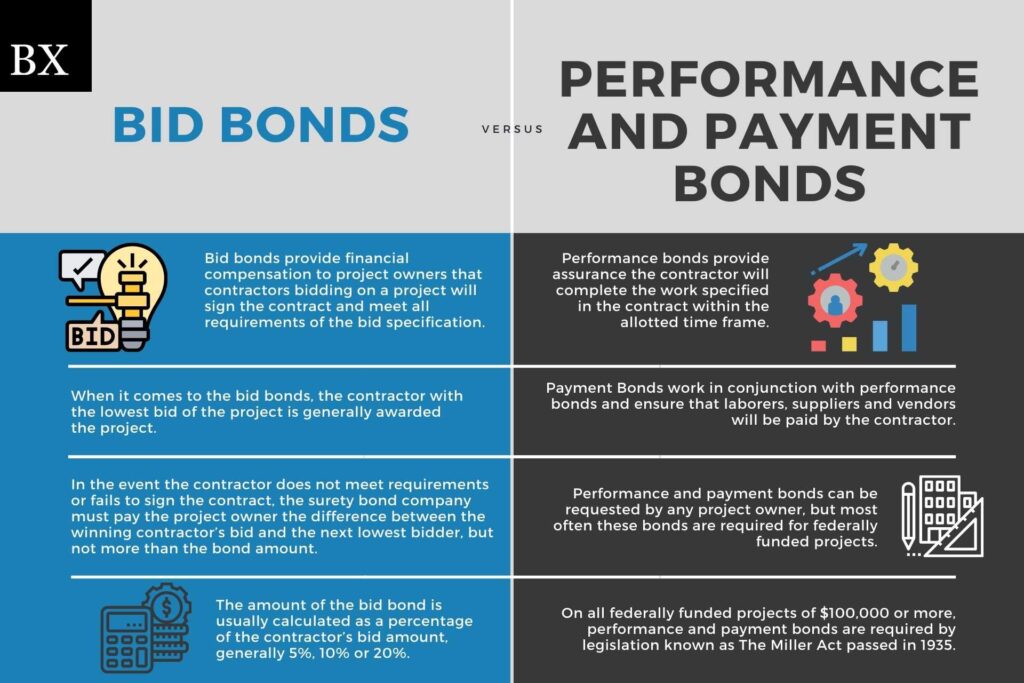

Tender Guarantee (Bid Bond):

A tender guarantee, often referred to as a bid bond, is a financial instrument issued by a bank or financial institution to guarantee that a bidder in a tender process will honor their commitment if awarded the contract. If the bidder withdraws or fails to sign the contract, the beneficiary (the tendering entity) can claim compensation under the guarantee.

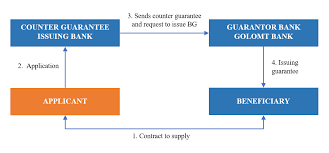

Counter-Guarantee:

A counter-guarantee is a secondary guarantee issued by one bank (the counter-guarantor) to back the primary guarantee issued by another bank. It is commonly used in international transactions where the primary guarantee needs to be issued by a local bank, but the contractor or bidder relies on a foreign bank for support.

Key Features

Tender Guarantee:

- Purpose: Ensures the bidder’s commitment to the tender terms.

- Amount: Typically a percentage of the project value (e.g., 1–5%).

- Validity: Covers the bidding process until the contract is awarded or the tender expires.

- Claim: Beneficiaries can claim compensation if the bidder withdraws, fails to sign, or does not provide performance guarantees.

Counter-Guarantee:

- Purpose: Adds an additional layer of security for the issuing bank in international transactions.

- Parties Involved: Typically involves the contractor, the local bank issuing the tender guarantee, and the foreign bank issuing the counter-guarantee.

- Functionality: The counter-guarantee ensures the local bank is indemnified if the tender guarantee is called upon.

Real-World Example Using Credit Suisse and ICICI Bank

A tender guarantee (bid bond) ensures a contractor or bidder’s compliance with contractual obligations, while a counter-guarantee serves as a backing instrument in cases where the issuing bank seeks indemnity from another bank in international or high-value transactions. Below is a real-world scenario illustrating these mechanisms in action, involving Credit Suisse (Switzerland) and ICICI Bank (India).

Real-World Example

A consortium consisting of Tahal Consulting Engineers India Private Limited and Concrete Udyog Limited (collectively “Tahal-CUL”) secured a tender from U.P. Jal Nigam for a large-scale water infrastructure project in Jhansi, India, under the AMRUT Program. As part of the contractual requirements, Tahal-CUL needed to furnish a payment guarantee for advance mobilization funds.

To facilitate the process:

- Credit Suisse AG, headquartered in Zurich, Switzerland, issued a counter-guarantee to back the tender guarantee to be provided by a local Indian bank.

- ICICI Bank Limited, based in Mumbai, India, issued the payment guarantee to U.P. Jal Nigam, enabling the consortium to receive the mobilization advance of INR 18.7 crore.

Key Steps in the Transaction:

Counter-Guarantee Issuance by Credit Suisse:

- Credit Suisse AG provided a counter-guarantee for USD 2.6 million, ensuring that ICICI Bank would be reimbursed in case the tender guarantee was called upon.

- The counter-guarantee covered all claims and charges arising from ICICI Bank’s obligations under the primary guarantee.

Primary Guarantee Issued by ICICI Bank:

- ICICI Bank, relying on Credit Suisse’s counter-guarantee, issued the required payment guarantee to U.P. Jal Nigam.

- The guarantee amount covered the mobilization advance provided to Tahal-CUL, ensuring financial security for the project.

Beneficiary Protection:

- In case Tahal-CUL defaulted on its contractual obligations or failed to utilize the mobilization funds appropriately, U.P. Jal Nigam could invoke the guarantee by submitting a demand to ICICI Bank.

- ICICI Bank, upon fulfilling the claim, would seek reimbursement from Credit Suisse under the counter-guarantee agreement.

Guarantee Details:

- Beneficiary: U.P. Jal Nigam

- Issuer of Payment Guarantee: ICICI Bank Ltd. (Mumbai, India)

- Counter-Guarantee Provider: Credit Suisse AG (Zurich, Switzerland)

- Guarantee Amount:

- Payment Guarantee: INR 18.7 crore

- Counter-Guarantee: USD 2.6 million

- Validity:

- Payment Guarantee: Valid until January 20, 2025

- Counter-Guarantee: Valid until February 20, 2024

Advantages of the Setup

For U.P. Jal Nigam (Beneficiary):

- Ensured financial security for the mobilization advance.

- Provided confidence in Tahal-CUL’s ability to execute the project.

For Tahal-CUL (Contractor):

- Enabled the consortium to access mobilization funds quickly.

- Facilitated compliance with tender requirements without tying up significant working capital.

For Credit Suisse & ICICI Bank:

- Credit Suisse mitigated its risk exposure by leveraging ICICI Bank’s local expertise and jurisdictional presence.

- ICICI Bank, in turn, had the backing of a reputed international counter-guarantee, ensuring indemnity.

Credit Suisse (Schweiz) AG

Head Office Administration

8070 Zürich

D R A F T dated 26.02.2024

DRAFT No. PSGAX213–1318877

++ THIS COUNTER-GUARANTEE WILL BE ADVISED BY AUTHENTICATED SWIFT THROUGH CREDIT SUISSE (SWITZERLAND) LTD. TO ICICI BANK LIMITED, MUMBAI ++

From:

CREDIT SUISSE AG

Guarantees Dept. SGAX 213

Uetlibergstrasse 231

8070 Zurich

Switzerland..

.

To:

ICICI Bank Limited

Empire House, Floor 1

414 Senapati Bapat Marg

Lower Parel

IN-Mumbai 400013 India

Attn. Guarantees Dept. (CTSU)

BIC: ICICINBBCTS (Mumbai)

Our counter-guarantee no. XXXXXX

The guarantee wording has been vetted between ICICI and Tahal Consulting Engineers

India Private Limited and Concrete Udyog Limited.

Dear Sirs,

We, CREDIT SUISSE AG, 8070 Zurich/Switzerland, hereby instruct and request you to

issue under our full responsibility a Payment Guarantee as per the following wording:

Q U O T E

BANK GUARANTEE FOR ADVANCE/MOBILISATION LOAN

.

To,

The Project Manager

Construction Unit

U.P. Jal Nigam,

Jhansi, UP 284001

Ident-№02890297

Page 1/4

INDIA

Name of the work: Survey, Design, Soil testing, Supply, Construction, Installation, Laying,

Jointing, Testing, Commissioning and Trial run of Raw water Intake well cum Pump House,

Raw Water Rising Main from intake well to Constant Pressure Tank, CP Tank, Raw Water

gravity main form CP Tank to Water Treatment Plant at Babina, 195 Mld W.T.P., Clear

water gravity main from W.T.P. Babina to Clear water Reservoirs of different zonal CWR at

Jhansi, Rising Mains from CWR’s to OHT’s in Different zones Distribution system of 16

zones including appurtenant works, pumping plants and electric Sub Station works,

Automation and PLC-SCADA with leak-detection System including supply of all material,

labour ,T&P etc. all complete on Turn-Key Basis Under AMRUT Programme.

WHEREAS JV of Tahal- CUL consisting of Partners Tahal Consulting Engineers India

Private Limited having its registered office at Plot №34, Phase — 2, 2nd Floor, Sector

-44, Institutional Area, Gurgaon, Haryana — 122003 and Concrete Udyog Limited

having its registered office at Flat №211, Prem Ratan Vatika (hereinafter called” the

contractor/Bidder”) has undertaken, in pursuance of Contract Number: Agreement No. –

01/SE 5th Circle — 2019–20 dated 17–06–2019 to execute the work “Survey, Design,

Soil testing, Supply, Construction, Installation, Laying, Jointing, Testing,

Commissioning and Trial run of Raw water Intake well cum Pump House, Raw

Water Rising Main from intake to Constant Pressure Tank, CP Tank, Raw Water

gravity main form CP Tank to Water Treatment Plant at Babina, 195 Mld W.T.P.,

Clear Water gravity main from W.T.P. Babina to Clear water Reservoirs of different

zonal CWR at Jhansi, Rising Mains from CWR’s to OHT’s in Different zones

Distribution system of 16 zones including appurtenant works, pumping plants and

electric Sub Station works, Automation and PLC-SCADA with leak-detection

System including supply of all material, labour ,T&P etc. all complete on Turn-Key

Basis Under AMRUT Programme”at Jhansi from UP jal nigam called the “contract”.

AND WHEREAS it has been stipulated by you in the said contract that the contractor/

Bidder shall furnish you with Advance Bank Guarantee by a recognized Bank for the sum

specified therein as security for compliance with his obligations in accordance with the

contract for getting mobilization advance from you.

AND WHEREAS we have agreed to give the Contractor such Advance Bank Guarantee.

NOW THEREFORE, We, (Bank Name and Address) ICICI Bank Ltd. A Schedule bank in

India incorporated under the provisions of the Companies Act, 1956 and having its

registered office at ICICI Bank Tower , Near Chakli Circle, Old Padra, road, Vadodra-

390007, India and having a branch office at ICICI Bank Ltd, Unit No.-1, Solitaire Plaza,

DLF Phase III, M.G. Road, 122001, Gurgaon, Haryana hereby affirm that we are the

Guarantor and responsible to you on behalf of the Contractor, up to a total of amount of

advance bank Guarantee i.e. Rs.18,70,00,000/- (Rupees Eighteen Crores Seventy

Lakh only.)

.

We, Bank Name and Address) We ICICI Bank Ltd. A Schedule bank in India incorporated

under the provisions of the Companies Act, 1956 and having its registered office at ICICI

Bank Tower , Near Chakli Circle, Old Padra, road, Vadodra- 390007, India and having a

branch office at ICICI Bank Ltd, Unit No.-1, Solitaire Plaza, DLF Phase III, M.G. Road,

122001, Gurgaon, Haryanaundertake to pay you upon your written demand and without

cavil and argument, any sum or sums within the limits of Rs.18,70,00,000/- (Rupees

Eighteen Crores Seventy Lakh only.) aforesaid without your heeding to prove or to show

the grounds or reason for your demand for the sum specified therein.

.

Ident-№02890297

Page 2/4

We hereby waive the necessity of your demanding the said debt from the Contractor before

presenting us with the demand.

.

We further agree that no change or addition to or other modifications of the terms of the

contract or of few works to be performed there under or any of the contract documents

which may be made between you and the Contractor shall in any way release us from any

ability under this advance bank guarantee, and we hereby waive notice of any such change,

addition or modification. This advance bank guarantee is valid up to 20th January 2025

.

The advance bank guarantee can be en-cashed by you at our branch ICICI Bank Ltd, Unit

No.-1, Solitaire Plaza, DLF Phase III, M.G. Road, 122001, Gurgaon, Haryana.

.

We Bank (Name and Address) ICICI Bank Ltd, Unit No.-1, Solitaire Plaza, DLF Phase III,

M.G. Road, 122001, Gurgaon, Haryana lastly undertake not to revoke this advance bank

guarantee during its currency except with the previous consent of the Authority in writing.

.

“THE LIABILITY OF THE GUARANTOR UNDER THIS GUARANTEE SHALL NOT

EXCEED Rs.18,70,00,000/- (Rupees Eighteen Crores Seventy Lakh only.)

THIS GUARANTEE SHALL BE VALID UP TO 20th January 2025 (THE “EXPIRY DATE”).

NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED HEREIN, NO

OBLIGATION OF THE GUARANTOR TO PAY ANY AMOUNT UNDER THIS

GUARANTEE SHALL ARISE PRIOR TO THE FULFILLMENT OF THE FOLLOWING

CONDITIONS PRECEDENT:

A) WRITTEN CLAIM/DEMAND(S) IN TERMS OF THIS GUARANTEE OF AN

AGGREGATE AMOUNT LESS THAN OR EQUAL TO THE GUARANTEED AMOUNTS

IS/ARE MADE BY THE BENEFICIARY HEREUNDER; AND

B) SUCH WRITTEN CLAIM/DEMAND(S) IS/ARE DELIVERED TO THE

GUARANTOR ON OR BEFORE THE EXPIRY DATE AT THE BANK BRANCH LOCATED

AT ICICI Bank Ltd, Unit No.-1, Solitaire Plaza, DLF Phase III, M.G. Road, 122001,

Gurgaon, Haryana .”

.

The — — — — — — — — — — — — — — — — — — — — — — has here unto set his hand at ________ the

day of — — — — — — — -’20……

.

U N Q U O T E

.

.

We, CREDIT SUISSE AG, 8070 Zurich/Switzerland, hereby irrevocably and unconditionally

undertake to accept and honour your claim on receipt of your first demand by simple

worded authenticated swift or post, without submission of any documents and without

contestation by our principal or any other party and irrespective of any dispute between the

contracting parties, any amount up to a maximum of:

.

USD 2’600’000.00

(US-Dollars two million six hundred thousand)

.

plus legal interest for the days elapsed between the date of your payment request and the

date of our actual payment and all comm. and charges.

.

When you claim your commissions and charges from us please use Swift message type MT

730, MT768, MT 790 or MT 791 to significantly speed up the transfer process.

Furthermore please always mention the period covered (date to date), the rate applied and

any other details thereof. Otherwise, we shall keep your request on hold until the missing

information is provided to us.

Ident-№02890297

Page 3/4

.

Our liability towards your bank is valid until 20 February 2024 (two thousand twenty-four)

(12 months claim period and 1 month liability) and expires automatically and in full if your

demand for payment as outlined above has not reached us on or before that date.

.

This counter-guarantee shall not be impaired or discharged or released by any amendment

or change or modification in the terms of the principal contract or by any alteration or

amendment in the obligations undertaken by the applicant or under or any allied document

or by any change in the constitution of the bank, the applicant or the end beneficiary/or by

any arrangement made between the applicant or the end beneficiary, without the assent of

the bank or by any forbearance as to time, performance or otherwise shown or extended by

the applicant to the beneficiary.

.

We allow you to insert the address of your claiming branch in the bank guarantee text.

.

Your guarantee and our counter-guarantee are governed by and construed in accordance

with Indian laws and subject to exclusive jurisdiction of courts in India.

.

Please deliver the original of your Payment Guarantee to

…………………………………………………………………..

…………………………………………………………………..

…………………………………………………………………..

…………………………………………………………………..

…………………………………………………………………..

(Please add Company Name, Receiving person, Phone nr.)

.

and let us have two copies for our file.

.

This message is the operative instrument. No mail confirmation will follow.

.

CREDIT SUISSE AG

Guarantees Dept. SGAX 213

Uetlibergstrasse 231

8070 Zurich

Switzerland

Fax no. +41 44 337 28 43, E-mail: zurich.guarantees@credit-suisse.com

__________________________________________________________________________

Seen and approved:

Date:

Signature(s)

— — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — — —

Conclusion

The partnership between Credit Suisse and ICICI Bank demonstrates how tender guarantees and counter-guarantees are critical in international trade and large-scale infrastructure projects. These financial instruments reduce risk for all parties, streamline complex cross-border transactions, and facilitate the execution of high-value projects like the U.P. Jal Nigam water infrastructure program.

Such mechanisms underscore the role of financial institutions in supporting global commerce and infrastructure development, ensuring confidence and security at every stage of the transaction.