Finding Genuine Standby Letter of Credit (SBLC) Providers

One of the terms commonly misused is “SBLC provider”.

This guide aims to set the record straight on Standby Letters of Credit (SBLC) and offer clear guidance for companies on how to find genuine SBLC provider.

Genuine Standby Letters of Credit (SBLC) Providers: Who Are They?

A genuine SBLC provider is a bank or financial institution, such as General Credit Finance and Development Limited, that issues Standby Letters of Credit (SBLCs), Bank Guarantees (BGs), and other banking instruments. These providers assist clients in securing loans and project financing, activating credit lines, facilitating collateral transfers, supporting trade finance, and enhancing creditworthiness.

Standby Letters of Credit (SBLC) Definition

A standby letter of credit, abbreviated as SBLC, is a guarantee of payment by a bank on behalf of their client. It’s a safety net for the beneficiary, ensuring they receive payment should the applicant (the bank’s client) fail to fulfill a contractual obligation.

The SBLC is utilized in both international and domestic transactions, particularly when the seller and buyer are unfamiliar with each other. It serves to mitigate risks associated with such transactions. Some of these risks include the possibility of the buyer going bankrupt or having insufficient cash flow, which might prevent them from making timely payments to the seller. In the event of an adverse situation, the bank guarantees payment to the seller, provided that the seller meets the requirements outlined in the SBLC. This bank payment to the seller acts as a form of credit; the buyer is then responsible for repaying the principal amount plus interest as agreed upon with the bank.

Types of Standby Letters of Credit (SBLC)

Standby Letters of Credit (SBLC) can be categorized based on their purpose and the circumstances under which they are issued, each serving different purposes:

Understanding these types can help businesses select the most suitable SBLC for their needs. Here are the primary types: Performance SBLC

A Performance SBLC is used to guarantee the performance of a contract or obligation. It ensures that a party will fulfill its obligations, such as completing a project or delivering goods. If the party fails to perform, the bank issuing the SBLC will compensate the beneficiary, giving them assurance that the job will either be completed or they’ll be financially compensated. Performance SBLCs are commonly used in construction projects, service agreements, and similar scenarios where completing a task is essential. Financial SBLC Financial SBLC provides a guarantee for financial obligations, such as repayment of loans or payment for goods and services. If the party fails to fulfill their financial commitments, the bank will release the funds to the beneficiary. This type of SBLC is frequently used in international trade and financial transactions, ensuring that payments are made in a timely manner and in accordance with the terms of the agreement. Commercial SBLC

Commercial SBLC is a type of financial SBLC that specifically guarantees payment for goods or services in a commercial transaction. This SBLC is often issued by a bank on behalf of the buyer to ensure payment to the seller upon the successful completion of a transaction. By providing a security of payment to the seller, a commercial SBLC can help facilitate international trade and minimize the risk of non-payment.

Advantages and Disadvantages of a Standby Letter of Credit (SBLC).

A Standby Letter of Credit (SBLC) is a powerful financial instrument that provides payment security in trade, project financing, and international transactions. However, like any financial tool, it comes with both benefits and drawbacks.

Advantages of a Standby Letter of Credit (SBLC)

1. Payment Security & Trust Building

- For Sellers/Beneficiaries: Guarantees payment if the buyer defaults, reducing financial risks.

- For Buyers/Applicants: Enhances credibility, allowing businesses to negotiate better payment terms.

2. Supports International Trade & Business Expansion

- Facilitates cross-border transactions, ensuring sellers feel secure when dealing with unfamiliar buyers.

- Helps companies expand globally by providing assurance to foreign suppliers and contractors.

3. Enhances Creditworthiness

- A Standby Letter of Credit provider (usually a bank) backs the applicant’s financial reliability, improving their credibility in trade and financial markets.

4. Flexible Usage

- SBLCs can be used for payment guarantees, performance guarantees, or as collateral for loans.

- Ideal for securing government contracts, real estate deals, and project financing.

5. Alternative to Cash Collateral

- Businesses can use an SBLC instead of upfront cash deposits, allowing them to allocate funds for operations and growth.

6. Compliance with Global Banking Standards

- Governed by the Uniform Customs and Practice for Documentary Credits (UCP 600) or International Standby Practices (ISP98), ensuring legal security and global acceptance.

7. Helps Secure Financing & Loan Approvals

- Many financial institutions monetize SBLCs, allowing businesses to obtain non-recourse loans based on the credit strength of the issuing bank.

Disadvantages of a Standby Letter of Credit (SBLC)

1. Costly Fees & Bank Charges

- SBLC issuance and renewal fees can range from 1% to 10% of the total value, depending on the issuing bank and transaction complexity.

- Additional costs include processing fees, bank transmission fees (MT760), and compliance fees.

2. Complex Application & Approval Process

- Applicants must meet strict creditworthiness and due diligence requirements before a bank issues an SBLC.

- Banks often require collateral or cash reserves before issuing an SBLC.

3. Risk of Non-Performance Claims

- If the applicant fails to fulfill contractual obligations, the beneficiary can invoke the SBLC, and the bank is legally bound to pay.

- Fraudulent claims can lead to financial losses if an SBLC is misused.

4. Requires Strong Banking Relationships

- Not all banks issue SBLCs, and some institutions prioritize clients with strong financial standing and transaction history.

- Applicants often need to build trust and maintain good relationships with issuing banks.

5. Limited Use for Small Businesses

- Due to high costs and stringent requirements, small businesses may struggle to obtain SBLCs, limiting their ability to compete in global trade.

6. Currency & Country-Specific Risks

- SBLCs are subject to exchange rate fluctuations, especially in cross-border transactions.

- Political instability or sanctions on issuing banks may affect SBLC enforceability.

Is an SBLC Right for Your Business?

A Standby Letter of Credit (SBLC) is a valuable financial tool that secures payments, builds trust, and facilitates global trade. However, businesses must weigh the costs, requirements, and risks before opting for an SBLC.

If you need a trusted Standby Letter of Credit provider or SBLC monetization services, General Credit Finance and Development Limited (GCFDL) can help.

Uses of Standby Letters of Credit (SBLC)

Standby Letters of Credit (SBLC) serve various functions in international trade and finance, providing security and assurance to both buyers and sellers.

It is a payment of the last resort and is used when the seller/exporter feels the buyer/importer may have problems paying for goods received.

Here are some common uses of SBLC

- International Trade: SBLCs facilitate smooth international trade transactions by providing payment guarantees to exporters, ensuring they receive payment even if the importer defaults.

- Project Financing: Companies use SBLCs to secure financing for large projects. The SBLC guarantees payment to contractors and suppliers, ensuring project completion and reducing financial risks.

- Performance Guarantees: SBLCs serve as performance guarantees in construction and service contracts, assuring the client that the contractor will fulfill their obligations. If the contractor fails, the SBLC provides compensation.

- Commercial Real Estate: In commercial real estate, SBLCs can be used to guarantee lease payments, ensuring landlords receive rent even if the tenant defaults.

- Equipment Leasing: Businesses use SBLCs to guarantee payments for leased equipment, providing security to leasing companies and facilitating smoother leasing agreements.

- Supplier Payments: Companies use SBLCs to guarantee payments to suppliers, ensuring timely delivery of goods and services without requiring upfront payment.

- Credit Enhancement: SBLCs enhance the credit profile of companies, making it easier to secure loans and other forms of financing at more favorable terms.

- Risk Mitigation: By providing a financial safety net, SBLCs mitigate risks associated with non-payment and non-performance, giving both parties in a transaction greater confidence and security.

Bank Guarantee vs. Standby Letter of Credit (SBLC)

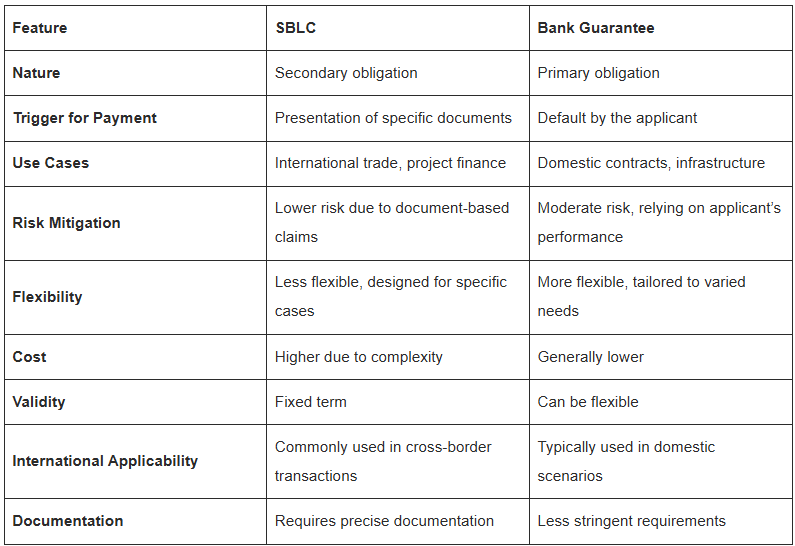

Both Bank Guarantees (BGs) and Standby Letters of Credit (SBLCs) are financial instruments issued by banks to protect businesses from financial risks. However, they serve different purposes and are used in distinct business scenarios.

Key Insights:

SBLCs are particularly well-suited for international trade and complex, high-value projects requiring robust documentation.

Bank Guarantees excel in domestic transactions and contracts where the assurance of performance or payment is needed without extensive documentation.

When to Use a Bank Guarantee vs. an SBLC

Opt for a Bank Guarantee when:

- Engaging in domestic contracts requires straightforward financial assurance.

- Managing projects with direct obligations and predictable risks.

Opt for an SBLC when:

- Participating in international trade requires cross-border financial security.

- Undertaking complex projects with multi-party involvement and detailed documentation requirements.

SBLC vs. Other Letters of Credit

While an SBLC and a standard Letter of Credit both involve a bank’s promise to pay, they differ in their primary functions:

- Backup Plan: An SBLC is designed as a fallback mechanism, intended to be used only if the primary payment method fails. In contrast, a standard Letter of Credit is a primary payment tool, with the expectation that it will be used as part of the regular transaction process.

- Performance Component: SBLCs can include performance-related terms, ensuring that contractual obligations are met. This aspect is less common in standard Letters of Credit, which focus more on the payment process itself.

- Usage: SBLCs are frequently used in domestic transactions, such as construction projects or utility services. Standard Letters of Credit are more prevalent in international trade, where they help facilitate cross-border transactions.

Standby Letter of Credit (SBLC) Monetization

Standby Letter of Credit (SBLC) monetization is the process of converting a Standby Letter of Credit (SBLC) into cash or legal tender. SBLC monetization process can either be a recourse or a non-recourse loan.

The Monetization Process

Monetization of SBLCs involves converting this financial instrument into liquid funds that can be used for investment or covering immediate business expenses. The process is marked by analytical scrutiny of collateral options and the deployment of strategic monetization strategies.Collateral OptionsMonetization StrategiesReal EstateLending AgreementsSecuritiesCredit Line EnhancementCash EquivalentsAsset-backed Financing

Benefits of SBLC Monetization

Harnessing the potential of SBLC monetization offers businesses a robust means to instantly enhance their cash flow and financial stability.

- Immediate liquidity without disposing of assets.

- Diversified Collateral Options facilitating transaction flexibility.

- Enhanced Credit Profile through Credit Enhancement.

- Strategic capital deployment for growth initiatives.

The Illusion of the ‘SBLC Supplier.’

Many brokers and platforms claim to be SBLC providers, suggesting they can issue or lease these letters directly. But this is not true because only banks or qualified financial institutions such as General Credit Finance and Development Limited have the authority to issue an SBLC.

The Real Process of Securing an SBLC

To get an SBLC, a company typically needs to provide collateral to the issuing bank. This collateral serves as security, ensuring that the bank can recover funds should the applicant fail to meet their obligation. a. Possessing Adequate Collateral: If a company already has enough collateral, they can approach their local bank or General Credit Finance and Development Limited to apply for an SBLC. b. Raising the Required Collateral: For companies without the necessary collateral, the journey to secure an SBLC is twofold: Secure Funding: This can be achieved through debt (borrowing from financial institutions or issuing bonds) or equity (selling shares or ownership stakes in the company). General Credit Finance and Development Limited can help you raise funds, or provide you with the required capital. Apply for the SBLC: Once the required capital is raised and serves as collateral, the company can then approach a qualified financial institution to apply for the SBLC.

Avoiding SBLC Frauds

Due to misunderstandings about “SBLC providers,” scams are common. Companies should exercise caution of: Too-Good-to-Be-True Offers: Offers that promise quick SBLC issuance without due diligence or adequate requirements.

Lack of Transparency: Entities that are unwilling to provide clear information about their process or their affiliations with recognized banks.

Who is a SBLC Provider?

A standby Letter of Credit (SBLC) Provider is a financial institution like General Credit Finance and Development Limited that is licensed to provide financial instruments and trade finance solutions such as BG bank Guarantees and Standby Letters of credit SBLC. At General Credit Finance and Development Limited (GCFDL), we specialize in bank guarantee issuance, SBLCs, and BG monetization, helping businesses secure funding for trade and projects worldwide.

At General Credit Finance and Development Limited, we exemplify these qualities by ensuring our SBLCs are issued and backed by some of the most reputable banks in the world, including Citibank, HSBC, Wells Fargo, and Barclays.

Key Attributes of #SBLC Providers

- Credibility and Reputation: Reputable SBLC providers have a proven track record and are known for their reliability and trustworthiness. They often have established relationships with major global banks and a history of successful transactions.

- Transparency: A genuine Standby Letter of Credit provider will offer clear terms and conditions, ensuring that clients fully understand the scope and limitations of the financial instruments they are acquiring.

- Regulatory Compliance: Legitimate SBLC / bank guarantee providers comply with financial regulations and standards, ensuring their operations are legal and ethical.

- Strong Banking Partnerships: Partnerships with top-rated global banks are a hallmark of a financial instrument providers like General Credit Finance and Development Limited (GCFDL). These partnerships ensure that the financial instruments offered are credible and backed by significant financial strength.

How to Identify Genuine Banks or Financial Institutions for SBLC

With the rise of fraudulent BG/SBLC providers in the financial instruments sector, it is essential to choose a genuine BG/SBLC provider. Unfortunately, many brokers and scammers disguise themselves as legitimate financial institutions, only to cause financial loss for unsuspecting customers.

Here are some red flags to watch out for when looking for a Genuine Standby Letter of Credit (SBLC) Provider:

1. Lack of Transparency

Reputable providers should offer clear and detailed information about their processes, fees, and terms. Be wary of providers who cannot clearly explain their services or who provide unclear processes or documentation.

2. Unrealistic Promises

If a provider promises to deliver BGs or SBLCs with no fees or no collateral requirements, it is likely a scam. There is no free bank guarantee or SBLC anywhere in the world.

3. No Track Record or Reputation

A reliable BG/SBLC provider will have a proven track record and client testimonials to back their services. Verify their credibility by checking their history, and any affiliations with recognized financial institutions or regulatory bodies.

4. Too Good to Be True Fees

If the fees seem unusually low or the terms too favorable, exercise caution. Often, scammers lure businesses with attractive pricing, only to disappear once payments have been made.

Please Read The Top 9 Reasons for Failure in Bank Instrument Transactions

SBLC Process- How to Obtain a Standby Letter of Credit (SBLC)

If you’re looking for a reputable SBLC or bank guarantee provider, General Credit Finance and Development Limited is the leading financial services company based in Hong Kong with over 51 years of trust and credibility. We offer bank instruments that can be used for securing loans, trade finance, or as collateral for credit lines. Here’s how you can apply for a BG or SBLC:

Applying for a Standby Letter of Credit (SBLC):

- Submit Your Application: Fill out the online application form on General Credit Finance and Development Limited (GCFDL) website and include detailed information about the transaction, including the parties involved and the amount of the SBLC.

- Assessment and Terms: Our trade finance department will assess your application and discuss the fees, terms, and conditions.

- Issuance: Once approved, the SBLC will be issued, providing you with the assurance that payments will be made if the applicant defaults.

Key Considerations:

- Collateral Requirements: All over the world, banks and providers require some form of collateral, depending on the size of the transaction. But General Credit Finance and Development Limited (GCFDL) is the only financial instrument provider that does not require collateral from customers before issuing a standby letter of credit. We have solution for every customer in every industry, and we also have a solution for customers who do not have collateral.

- Fees: Be prepared to pay fees based on the amount of the SBLC. These are calculated according to the terms of your agreement and the risks involved.

Contact The SBLC Experts:

Government Licensed Money Lenders like General Credit Finance and Development Limited are the right channels through which you can obtain real bank instruments such as SBLC, bank guarantees, and business loans. At General Credit Finance and Development Limited, we streamline financial instruments and provide dedicated support to help companies secure the capital they require.

Conclusion: Why Choose General Credit Finance and Development Limited (GCFDL)?

When seeking a Genuine SBLC Provider, General Credit Finance and Development Limited (GCFDL) stands out as a trusted, reliable, and government-licensed provider. With over 51 years of experience in the financial industry, General Credit Finance and Development Limited offers transparent, secure, and customized solutions to meet your business needs.

Don’t Risk Your Business with Fake SBLC Providers! Secure Your Future Now!

Finding a genuine Standby Letter of Credit (SBLC) provider can mean the difference between business success and financial disaster. Scammers are everywhere—don’t fall for false promises!

Want a REAL SBLC from top-rated banks?

Need secure SBLC monetization with guaranteed results?

Looking for expert guidance in trade finance?

Act Now and contact legitimate SBLC providers and avoid scams before it’s too late.

Website: www.gcfdl.com

Email: info@gcfdl.com

Contact us today for trusted SBLC issuance & monetization!

#StandbyLettersofCreditprovider #SBLCProvider #SBLCMonetization #BGSBLCProviders #FinancialInstrumentsProvider

[…] a reliable SBLC provider is challenging due to the high value and risk involved. Most reputable providers operate in […]

[…] Credit Finance and Development Limited (GCFDL) is a trusted bank guarantee provider, SBLC provider, and global project finance firm. With 52 years of expertise and strong banking partnerships with […]