Email Us Now: info@gcfdl.com

What is a Bank Guarantee (BG)?

As a business owner who is involved in international transactions, you have multiple payment options at your disposal. However, these payment options comes with risks—such as the potential for contract breaches or non-payment. To mitigate these risks and ensure smoother international operations, a bank guarantee can serve as a reliable safety measure. Widely used outside the United States, it’s essential to understand how a bank guarantee works and how it could benefit your business transactions.

What is a Bank Guarantee?

A bank guarantee is a financial commitment provided by a bank or financial institution that ensures the fulfillment of obligations by a debtor. In essence, it serves as a safeguard, guaranteeing that if a party in a contractual agreement defaults on its financial responsibilities, the bank will step in to cover the liabilities. This assurance is particularly relevant in high-stakes scenarios like international trade or large-scale business transactions, where the risk of non-performance or non-payment can disrupt business operations and undermine trust between parties.

Bank guarantees are instrumental in fostering business relationships, ensuring that even in the presence of uncertainties, parties can move forward confidently. By reducing the risk associated with financial commitments, they encourage trade and investment across borders and industries.

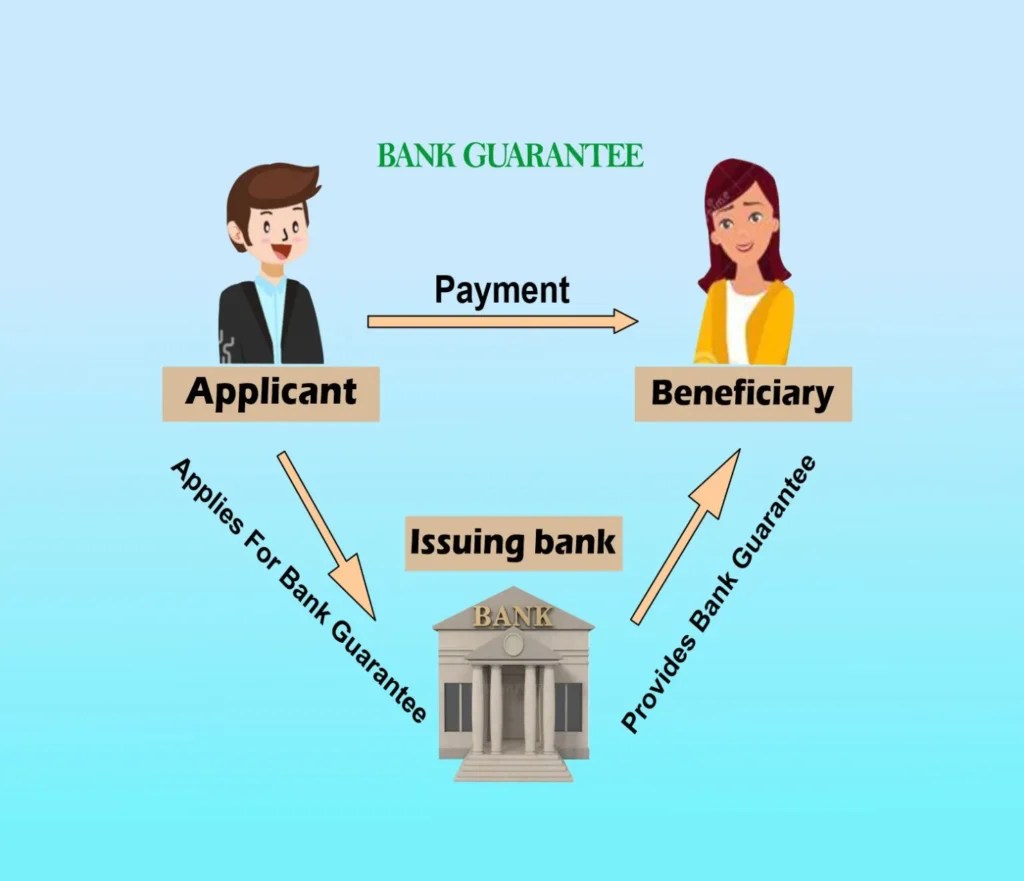

How Does a Bank Guarantee Work?

The mechanics of a bank guarantee involve three key stakeholders: the applicant, the beneficiary, and the issuing bank. Each plays a specific role in the process:

- The Applicant – This is the party that seeks the bank guarantee. Typically, the applicant is the buyer or the contractor in a transaction who has to assure the other party (beneficiary) of their ability to meet their financial obligations.

- The Beneficiary – The beneficiary is the party that receives the assurance provided by the bank guarantee. This could be a seller, contractor, or service provider, depending on the nature of the contract. The beneficiary is assured that they will be compensated if the applicant fails to fulfill the agreed-upon commitments.

- The Issuing Bank – The issuing bank assesses the creditworthiness of the applicant. If satisfied with the applicant’s financial standing, it issues a guarantee to the beneficiary. The bank commits to covering any financial shortfalls if the applicant defaults on their contractual duties.

The bank guarantee provides an essential layer of security for the beneficiary, who is often hesitant to engage in transactions that carry significant risk. Once issued, the beneficiary can proceed with confidence, knowing that the bank will honor the financial liabilities in case of default.

The Bank’s Role and Risk Management

Before a bank issues a guarantee, it conducts a comprehensive assessment of the applicant’s financial health. This involves reviewing the applicant’s credit history, current financial position, and business viability. The assessment process is rigorous, ensuring that only applicants with solid financial standing and sufficient collateral can secure a guarantee.

If the applicant defaults on their obligations, the bank will be required to compensate the beneficiary. While the bank has the right to recover the funds from the applicant, the immediate financial burden falls on the bank, which could pose a risk to its liquidity.

Related Reading: Trade Finance with Bank Guarantee Options

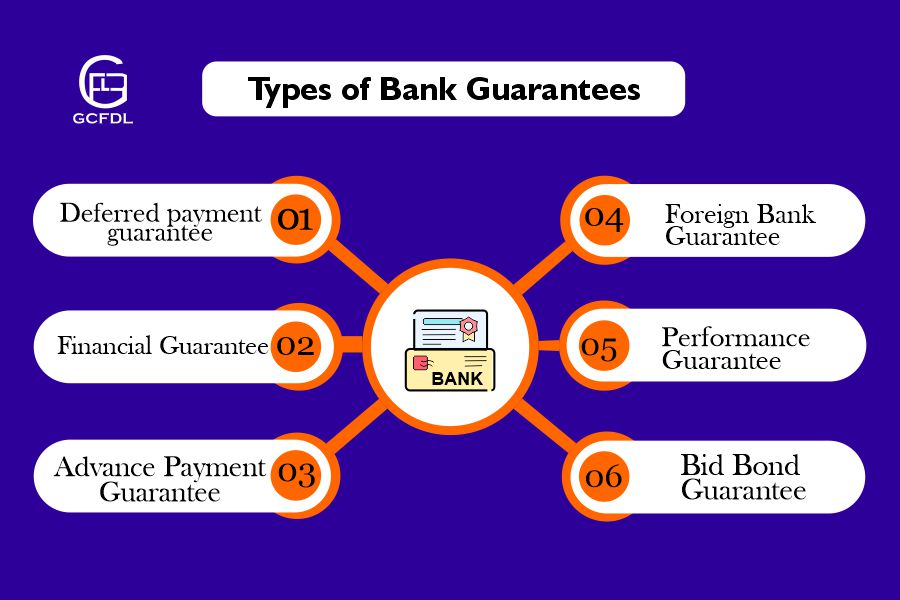

Types of Bank Guarantees

Bank guarantees can take several forms, each serving a specific purpose based on the underlying business transaction. Below are the common types of bank guarantees:

1. Performance Bond Guarantee

A performance bond guarantee is issued to ensure that a party fulfills its contractual obligations. It serves as collateral, providing the beneficiary with financial security in case the applicant (typically a service provider or supplier) fails to deliver as agreed in the contract. Performance bonds are commonly used in industries where projects are time-sensitive and have performance-based deliverables, such as construction.

- Scenario: A contractor is hired to build a facility within a specified timeframe. If the contractor fails to complete the project or deliver quality work, the performance bond guarantee compensates the project owner for the financial losses incurred due to the delay or substandard performance.

- Common Use: Construction projects, government contracts, and large-scale service agreements.

2. Advance Payment Guarantee

An advance payment guarantee protects the buyer when they make an upfront payment for goods or services. This type of guarantee ensures that if the seller does not fulfill their contractual obligations, the buyer can recover the advance payment. In international trade, where buyers often pay for goods or services before delivery, this type of guarantee mitigates the risk of non-performance.

- Scenario: A company orders machinery from a foreign supplier and makes an advance payment. If the supplier fails to deliver the machinery, the advance payment guarantee ensures the buyer recoups the funds.

- Common Use: Frequently employed in international trade, large-scale procurement, and transactions requiring substantial upfront payments.

3. Confirmed Payment Guarantee

A confirmed payment guarantee is used when the beneficiary seeks assurance that the buyer will fulfill their payment obligations. The bank confirms the buyer’s commitment, providing an additional layer of security for the seller. This is especially useful in cross-border transactions, where differences in legal systems and business practices can increase payment risks.

- Scenario: A company sells goods to a foreign buyer and requests a confirmed payment guarantee. If the buyer fails to make the payment, the bank steps in and ensures the seller receives the agreed amount.

- Common Use: Cross-border transactions and high-value business deals.

4. Security Bond Guarantee

A security bond guarantee offers protection against potential losses resulting from a party’s failure to meet its contractual obligations. This type of guarantee provides financial compensation to the affected party if the applicant defaults.

- Scenario: A real estate developer enters into an agreement with a contractor to complete a housing project. If the contractor fails to meet the project deadline or defaults on the contract, the security bond guarantee covers the losses incurred by the developer.

- Common Use: Real estate transactions, government contracts, and large infrastructure projects.

Advantages of Bank Guarantees

Bank guarantees offer several advantages to businesses, particularly small and medium enterprises (SMEs) that may otherwise face difficulties securing loans or engaging in high-risk contracts. The assurance provided by a bank guarantee can be the catalyst for business growth and expansion.

1. Encouragement of Business Activity

For small companies and startups, bank guarantees can open doors to new business opportunities that would otherwise be inaccessible due to perceived risks. By providing assurance to business partners or suppliers, these companies can engage in larger or more complex contracts without the fear of financial ruin if things don’t go as planned.

2. Low-Cost Security

The cost of obtaining a bank guarantee is relatively low. Banks typically charge a small fee for the service, usually a fraction of 1% of the total transaction amount. Given the protection and assurance provided by the bank, this cost is minimal, making bank guarantees an affordable risk management tool for businesses of all sizes.

3. Enhanced Credibility

Banks have specialized teams and sophisticated tools to evaluate the financial health of businesses. When a bank issues a guarantee, it vouches for the applicant’s creditworthiness, enhancing the applicant’s credibility. This backing can improve the applicant’s standing in the eyes of potential partners, investors, or suppliers, leading to better terms and more business opportunities.

Disadvantages of Bank Guarantees

Despite their numerous advantages, bank guarantees also come with certain disadvantages. Businesses must carefully weigh these drawbacks before applying for a bank guarantee.

1. Rigorous Assessment Process

Banks conduct thorough assessments of the applicant’s financial position before issuing a guarantee. This process can be time-consuming and cumbersome, especially for businesses that need quick access to credit or face tight timelines for fulfilling contracts. The stringent evaluation may also disqualify companies that have irregular cash flows or weaker financial health.

2. Financial Considerations

Obtaining a bank guarantee may not be suitable for all businesses. Loss-making entities or those with limited cash reserves may struggle to qualify, as banks typically require the applicant to provide some form of collateral. This can be a challenge for companies with insufficient assets or liquidity.

3. Risk to the Bank

In the event of default, the bank is obligated to fulfill the financial commitments outlined in the guarantee. This poses a risk to the bank, especially if the default occurs during an economic downturn or financial crisis. While banks have measures in place to mitigate these risks, the possibility of financial strain remains.

Applications of Bank Guarantees

Bank guarantees are versatile financial instruments that find application in various industries and business transactions. Their ability to mitigate risk and provide assurance makes them particularly useful in the following areas:

1. International Trade

International trade involves multiple risks, including non-payment, delivery failures, and disputes over quality. Bank guarantees play a critical role in reducing these risks, providing assurance to both buyers and sellers. Buyers can be confident that their payments will be refunded if goods are not delivered, while sellers are assured of receiving payments as per the contract.

2. Construction and Real Estate

In construction and real estate sectors, bank guarantees serve as performance bonds to ensure contractors meet their project milestones and obligations. They also provide security for developers and investors, protecting against delays or project abandonment. Real estate transactions may also involve bank guarantees to protect buyers from non-performance by developers or sellers.

3. Financial Transactions

Bank guarantees are commonly used in financial transactions such as loans, leases, and investments. They provide security to parties involved, reducing the likelihood of disputes or defaults. For example, in loan agreements, a bank guarantee can assure the lender that they will be repaid even if the borrower defaults on the loan.

Benefits of a Bank Guarantee

Bank guarantees offer numerous benefits to businesses and financial institutions alike. Below are some of the key advantages:

1. Risk Mitigation

A bank guarantee serves as a powerful risk mitigation tool. It provides assurance to the beneficiary that the bank will fulfill the applicant’s obligations if they are unable to do so. This significantly reduces the risk of loss for the beneficiary, making it easier to enter into contracts with unknown or less-established parties.

2. Credibility and Business Expansion

By securing a bank guarantee, businesses, especially small enterprises, gain a stamp of credibility from the issuing bank. This credibility allows them to expand into new markets, forge partnerships, and engage in larger contracts that would otherwise be unattainable. The backing of a reputable financial institution can be a game-changer for businesses seeking to grow and diversify.

3. Flexibility in Transactions

Bank guarantees provide flexibility in transactions by allowing businesses to engage in deals that require upfront payments or performance milestones. The guarantee assures the beneficiary that the applicant will meet their obligations, even if there are delays or challenges. This flexibility can facilitate complex transactions in industries such as manufacturing, infrastructure development, and international trade.

Real-World Example of a Bank Guarantee in the Healthcare Industry

A bank guarantee is essential in ensuring smooth transactions in healthcare infrastructure, medical equipment procurement, and hospital projects. In this example, we will explore how a payment bank guarantee supports a hospital expansion project.

Hospital Expansion & Medical Equipment Procurement

Parties Involved:

- Hospital: BrightCare Medical Center (South Africa) – A private hospital expanding its facilities.

- Medical Equipment Supplier: MedTech Solutions Ltd. (Germany) – A manufacturer and supplier of advanced medical equipment.

- Bank Guarantee Provider: General Credit Finance and Development Limited (GCFDL).

Step-by-Step Process:

1. Contract Agreement

BrightCare Medical Center plans to expand its operations by adding three new operating rooms and a state-of-the-art radiology department. The hospital enters a $15 million contract with MedTech Solutions Ltd. to purchase MRI scanners, X-ray machines, and surgical equipment.

However, MedTech Solutions Ltd. requires payment security before manufacturing and shipping the equipment. To mitigate non-payment risks, they request a payment bank guarantee of $15 million from BrightCare Medical Center.

2. Request for Bank Guarantee

BrightCare Medical Center approaches General Credit Finance and Development Limited (GCFDL) to issue a payment bank guarantee in favor of MedTech Solutions Ltd.

Before issuing the guarantee, GCFDL evaluates:

BrightCare’s financial standing and cash flow.

The hospital’s repayment ability.

The project’s feasibility and funding sources.

Collateral or security offered.

Once BrightCare meets all the requirements, GCFDL approves and processes the bank guarantee.

3. Issuance of Bank Guarantee

GCFDL issues a $15 million payment bank guarantee to MedTech Solutions Ltd., ensuring that if BrightCare Medical Center defaults, MedTech Solutions will receive payment from GCFDL.

This financial assurance allows MedTech Solutions to proceed with the manufacturing and shipment of the medical equipment without concerns about non-payment risks.

4. Delivery of Medical Equipment

MedTech Solutions manufactures the equipment.

Ships the medical machines to BrightCare Medical Center.

Provides all necessary compliance and quality control certifications.

5. Default on Payment & Invocation of the Bank Guarantee

Due to unexpected financial difficulties, BrightCare Medical Center failed to pay the full amount upon equipment delivery. MedTech Solutions Ltd. formally invokes the bank guarantee and submits a claim to GCFDL.

6. Bank Pays the Compensation

After verifying the claim, GCFDL pays MedTech Solutions Ltd. the guaranteed amount of $15 million, as per the terms of the payment bank guarantee.

7. Recovery Process

Following the payout, GCFDL seeks reimbursement from BrightCare Medical Center, using the collateral provided or negotiating a repayment agreement.

Impact and Benefits

For the Hospital (BrightCare Medical Center):

- Secures essential medical equipment without immediate full payment.

- Strengthens relationships with global suppliers.

- Enables hospital expansion and improved healthcare services.

For the Supplier (MedTech Solutions Ltd.):

- Ensures full payment for delivered medical equipment.

- Reduces financial risks in cross-border transactions.

- Builds trust in exporting high-value medical devices.

For GCFDL (Bank Guarantee Provider):

- Earns fees for issuing the guarantee.

- Strengthens its role in healthcare financing.

- Enhances trust and reliability in global medical supply chains.

This case demonstrates how General Credit Finance and Development Limited (GCFDL) facilitates healthcare infrastructure development by providing secure financial solutions like payment bank guarantees.

By acting as a trusted intermediary, GCFDL ensures hospitals can acquire advanced medical equipment, while suppliers receive payment protection, ultimately improving healthcare access and medical services.

Bank Guarantee vs. Standby Letter of Credit: The Key Differences

While both a bank guarantee and a standby letter of credit involve the issuing bank accepting liability if the customer defaults, there are notable differences between the two:

- Claim Process: With a bank guarantee, the seller’s claim first goes to the buyer, and if the buyer defaults, the bank steps in to fulfill the obligation. In contrast, with a standby letter of credit, the claim goes directly to the bank, providing the seller with greater assurance.

- Legal Framework: Bank guarantees are governed by civil law, whereas standby letters of credit are subject to specific banking protocols.

- Practical Application: Bank guarantees tend to be more practical in broader business contexts, particularly for contractors. Standby letters of credit, on the other hand, are more commonly used by companies involved in importing and exporting.

Do U.S. Banks Issue Bank Guarantees?

In short, no. Banks in the United States do not issue bank guarantees. Instead, they provide standby letters of credit (SBLC), which serve a similar function. While bank guarantees are commonly used in many countries, including Germany, France, Spain, Austria, Belgium, and the United Kingdom, U.S. banks rely on SBLCs to fulfill the same role.

A bank guarantee from a reputable institution can enhance business relationships, improve access to cash flow and capital, protect against losses, and open doors for international opportunities.

So U.S. banks issue standby letters of credit, not bank guarantees, though both instruments provide similar protections in commercial transactions.

A bank guarantee is a critical financial tool that facilitates business transactions by reducing risk and providing assurance to all parties involved. Whether in international trade, construction, or financial transactions, bank guarantees play a vital role in promoting business confidence and encouraging economic growth. However, businesses must carefully consider both the advantages and disadvantages before opting for a bank guarantee, ensuring that they meet the financial and collateral requirements necessary to obtain this powerful instrument. With the right approach, bank guarantees can unlock new opportunities for businesses, fostering trust and stability in even the most complex transactions.

Who Are Bank Guarantee Providers?

Bank Guarantee Providers are financial institutions like General Credit Finance and Development Limited that are licensed and regulated to provide financial instruments and trade finance solutions such as BG bank Guarantees and Standby Letters of credit SBLC. At General Credit Finance and Development Limited (GCFDL), we specialize in bank guarantee issuance, SBLCs, and BG monetization, helping businesses secure funding for trade and projects worldwide.

These providers are often recognized for their transparency, reputation, and strong partnerships with top global banks.

At General Credit Finance and Development Limited, we exemplify these qualities by ensuring our instruments are backed by some of the most reputable banks in the world, including Citibank, HSBC, Wells Fargo, and Barclays.

Key Attributes of #Bank Guarantee Providers

- Credibility and Reputation: Bank Guarantee providers have a proven track record and are known for their reliability and trustworthiness. They often have established relationships with major global banks and a history of successful transactions.

- Transparency: A reliable bank guarantee provider will offer clear terms and conditions, ensuring that clients fully understand the scope and limitations of the financial instruments they are acquiring.

- Regulatory Compliance: Legitimate bank guarantee providers comply with financial regulations and standards, ensuring their operations are legal and ethical.

- Strong Banking Partnerships: Partnerships with top-rated global banks are a hallmark of a genuine bank guarantee providers like General Credit Finance and Development Limited (GCFDL). These partnerships ensure that the financial instruments offered are credible and backed by significant financial strength.

Navigating International Trade Risks? Trade finance tools like SBLCs, Bank Guarantees, and Letters of Credit help businesses secure deals, manage cash flow, and protect against non-payment risks.

Bank Guarantee Process- How to obtain a Bank Guarantee (BG).

One of the easiest and best ways to obtain a bank Guarantee (BG) is through a trustworthy financial institution like General Credit Finance and Development Limited (GCFDL), which was incorporated in Hong Kong as a Government Licensed Money Lender. We are leading providers of bank guarantees, Business Loans, Project Financing, Recourse Loans, Non Recourse Loans and Trade Finance tools like Standby Letter of Credit and Bank Guarantees etc.

For over 51 years, we have been providing these financial services to our numerous customers all over the world, including importers, exporters as well as customers that need credit enhancements or trade finance facilities to import or export goods and services.

Our bank instruments, BGs, and SBLCs are issued by top banks such as HSBC Hong Kong, Barclays Bank London, Standard Chartered Bank etc.. All our financial instruments are cash-backed and can be used as collateral to secure funding for projects, discounting, monetization, and Private Placement Programs (PPP).

We can help you obtain financing for your business or projects, activate credit lines, issue and provide letters of credit, BG, or SBLC for you, provide loans against financial instruments, and monetize your financial instruments.

Please Read How #GCFDL provided $350M Funding for 135MW Solar Project in Thailand

Secure Your Business with a Trusted Bank Guarantee Provider! 🚀

Are you looking for a reliable Bank Guarantee Provider or a trusted SBLC Monetization Company to help you unlock funding, secure trade deals, or expand your business? General Credit Finance and Development Limited (GCFDL) is here to provide fast, secure, and globally accepted SBLC and Bank Guarantee solutions tailored to your needs.

Don’t wait—Your financial success starts now! Contact us today and let’s discuss how we can support your business.

Email: info@gcfdl.com

Website: www.gcfdl.com

Take the next step—Get in touch and secure your financial future today!

#BankGuarantee #BankGuaranteeProvider #BGProvider #SBLC #BankGuaranteeMonetizer

[…] A Bank Guarantee is a financial promise from a bank to cover a specific amount if a client (the principal) fails to meet their contractual obligations. This instrument is used to protect the beneficiary against default by the principal. BGs are often required in various scenarios such as performance bonds, tender guarantees, or advance payment guarantees. They provide a safety net for the beneficiary by ensuring that they will receive compensation in case the principal fails to perform as agreed. […]

[…] bank guarantee is a guarantee given by the bank on behalf of the applicant to cover a payment obligation to a […]

[…] already explained, Bank Instrument refers to financial tools such as bank guarantees, indemnities, letters of credit (including import letters of credit and standby letters of credit), […]

[…] What is a Bank Guarantee (BG)? […]

[…] para empresas que buscam prosperar em mercados globais.O que é uma garantia bancária?Uma garantia bancária é um compromisso de um banco para cobrir as obrigações financeiras de um cliente se ele deixar […]

[…] garantía bancaria es un compromiso por parte de un banco de cubrir las obligaciones financieras de un cliente si este […]

[…] What is a Bank Guarantee (BG)? […]

[…] of Credit (LC): A financial guarantee provided by the buyer’s bank ensuring that the seller will receive payment once the shipment and […]

[…] Collateral Transfer, and Trade Finance Services, especially Standby Letters of Credit (SBLC) and Bank Guarantees (BG) issuance and monetization […]

[…] Click Here to Explore Our Detailed Article on Bank Guarantees and How They Work […]

[…] What is a Bank Guarantee (BG)? […]