Email Us Now: info@gcfdl.com

Understanding Standby Letters of Credit (SBLC)

In today’s complex financing landscape, Standby Letters of Credit (SBLCs) have become essential for companies offering loans and credit facilities. An SBLC acts as a guarantee from a bank, ensuring payment to a beneficiary if specific conditions are met.

Understanding Standby Letters of Credit (SBLC) and Their Role in Business Financing

The global rule sets which govern standby letters of credit (SBLC) – both the Uniform Customs and Practices current revision 600 (UCP 600) and International Standby Practices current revision (ISP98) – define a SBLC as an “undertaking”. An undertaking provides the named beneficiary with an “independent” assurance of payment from the undertaking’s issuer (issuers are most often banks).

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. It is a payment of last resort from the bank, and ideally, is never meant to be used. A standby letter of credit helps facilitate international trade between companies that don’t know each other and have different laws and regulations. A Standby Letter of Credit can be abbreviated SLOC or SBLC.

Types of Standby Letters of Credit (SBLC)

Here’s a breakdown of the types of Standby Letters of Credit (SBLC) based on your list:

- Revolving Letter of Credit

A credit that automatically renews after the original amount is drawn, providing continuous funding for ongoing transactions. - Advance Payment SBLC

Used to secure advance payments to a seller, ensuring they receive funds before fulfilling their contractual obligations. - Back-to-Back Letter of Credit

Two letters of credit that are interconnected, allowing an intermediary to facilitate a transaction between two parties. - Irrevocable Letter of Credit

Cannot be amended or canceled without the agreement of all parties involved, offering strong security for beneficiaries. - Bid SBLC

Issued to guarantee that a bidder will undertake a contract if awarded, protecting the interests of the project owner. - Commercial Letter of Credit

Primarily used in international trade, ensuring payment for goods or services upon presentation of specified documents. - Counter SBLC

A secondary SBLC provided by one bank to another, guaranteeing the obligations of a primary SBLC. - Insurance SBLC

Guarantees payment obligations related to insurance contracts, protecting the insured party from default. - Red Clause Letter of Credit

Allows the beneficiary to receive an advance payment before shipping goods, facilitating immediate cash flow. - Standby Letters of Credit (SBLC)

General term for letters issued as a backup guarantee, activated if the applicant defaults on obligations. - Bid and Performance Bonds

Financial instruments that ensure a contractor will complete a project according to the terms of a contract. - Confirmed Letter of Credit

A letter of credit that includes a confirmation from a second bank, adding an extra layer of security for the beneficiary. - Financial SBLC

Guarantees the financial obligations of the applicant to the beneficiary, ensuring payment in case of default. - Performance SBLC

Protects the beneficiary from non-performance by the applicant, ensuring they receive compensation if obligations are not met. - Risk Management SBLC

Serves as a tool for managing risks in financial transactions, providing assurance against defaults. - Sight Letter of Credit

Payment is made upon presentation of required documents, ensuring immediate funds for the beneficiary.

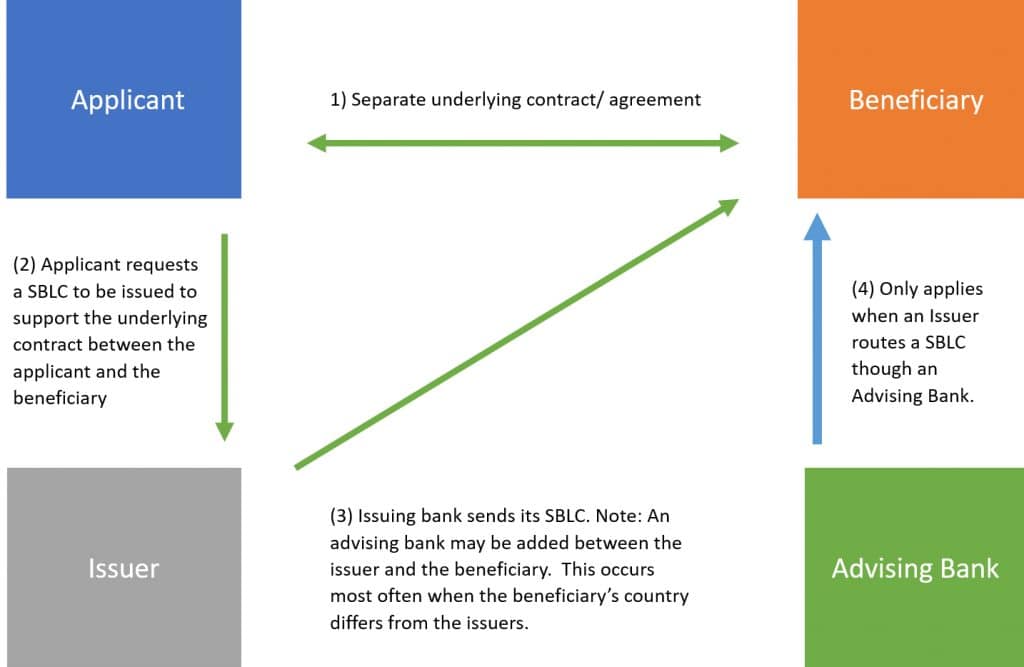

Example of a typical SBLC Process

SBLC issuance process – direct to beneficiary or utilizing an advising bank

Here are the Benefits of Standby Letters of Credit (SBLC) in Business Financing

1. Enhanced Credibility and Trust

One of the foremost advantages of using SBLCs is the increased credibility they provide to both lenders and borrowers. For businesses issuing SBLCs, backing their loans with this financial instrument demonstrates a commitment to honoring financial obligations. This not only enhances the lender’s reputation but also instills confidence in borrowers, making them more likely to engage in financial transactions.

2. Risk Mitigation

For businesses that lend money, risk management is crucial. SBLCs serve as a safety net, protecting lenders from potential defaults. If a borrower fails to meet their obligations, the lender can draw on the SBLC to recover losses, thus minimizing financial risk. This assurance can make it easier for lenders to extend credit to businesses that may otherwise be considered too risky

3. Access to Larger Loans

With the security provided by an SBLC, lenders can feel more comfortable extending larger loan amounts. The backing of a credible financial institution allows businesses to leverage more significant sums of money than they might otherwise be able to obtain. This can be particularly beneficial for businesses seeking to fund major projects or expansions.

4. Flexibility in Financing Options

SBLCs can be structured in various ways to meet the specific needs of both lenders and borrowers. This flexibility allows businesses to tailor financing solutions that align with their goals and financial situations. For example, SBLCs can be used for specific transactions, such as international trade, or can be integrated into broader financing strategies.

5. Improved Cash Flow Management

For businesses, maintaining healthy cash flow is vital for operations. SBLCs can help manage cash flow by allowing companies to secure loans without tying up their existing capital. Instead of using cash reserves as collateral, businesses can use SBLCs to guarantee loans, freeing up their cash for other operational needs.

6. Facilitation of International Trade

In today’s global economy, many businesses engage in international trade, which often involves complex financial arrangements. SBLCs are particularly useful in this context, as they provide a reliable payment guarantee across borders. This can simplify transactions and reduce the risk of non-payment, making it easier for businesses to expand into new markets.

7. Attracting More Clients

For businesses that offer SBLCs and loans, having a robust backing mechanism can attract more clients. Potential borrowers are often more inclined to work with lenders who can provide additional security through SBLCs, as it offers them peace of mind. This can lead to an increase in client base and ultimately higher revenue for the lending business.

8. Streamlined Transaction Processes

Using SBLCs can lead to more efficient transaction processes. The presence of a standby letter of credit can expedite approval and disbursement of loans, as banks and lenders have a clear mechanism for securing their interests. This speed can be a significant advantage in a competitive market where businesses need to access funds quickly to seize opportunities.

SBLCs vs Bank Guarantees

Differences Between Standby Letters of Credit (SBLC) and Bank Guarantees (BG)

- Nature of Guarantee:

- BG: Provides a broader guarantee of performance or payment; covers loss if the applicant fails to fulfill obligations.

- SBLC: Primarily guarantees payment; serves as a last resort if the buyer defaults.

- Usage Context:

- BG: Commonly used in construction and performance contracts.

- SBLC: Frequently utilized in international trade for payment security.

- Parties Involved:

- BG: Involves two parties: the applicant and the beneficiary.

- SBLC: Involves three parties: the applicant, the issuing bank, and the beneficiary.

- Payment Conditions:

- BG: Payment may occur even before the applicant defaults.

- SBLC: Payment is made only after the applicant fails to meet obligations.

- Types:

- Both BG and SBLC can be categorized into various types (e.g., Performance, Financial, Advance Payment) based on their specific uses.

- Regulatory Framework:

- BG: Governed by the Uniform Rules for Demand Guarantees (URDG).

- SBLC: Regulated by International Standby Practices (ISP98).

- Scope of Usage:

- BG: Used for both long-term and short-term transactions (e.g., real estate, construction).

- SBLC: Typically associated with long-term contracts.

- Scope of Protection:

- BG: Protects both the seller and the buyer.

- SBLC: Primarily protects the seller.

- Legal Difference:

- BG: Subject to civil law obligations.

- SBLC: Governed by banking protocols.

- Scope of Practicality:

- BG: More practical for covering financial performance.

- SBLC: Can cover both financial and non-financial factors.

- Type of Payment Covered:

- BG: Immediate coverage for performance-related obligations.

- SBLC: Secondary payment mechanism; bank pays only if the buyer defaults.

Standby Letter of Credit (SBLC) provider

A Standby Letter of Credit (SBLC) provider is typically a bank or financial institution like General Credit Finance and Development Limited, that issues the SBLC on behalf of a client (the applicant). The SBLC provider guarantees payment to a designated beneficiary in the event that the applicant defaults on their obligations.

Key Roles of an SBLC Provider:

- Issuing Bank: The primary role is to issue the SBLC based on the applicant’s request, providing a guarantee of payment.

- Assessment of Risk: The provider evaluates the applicant’s creditworthiness and financial stability before issuing the SBLC to mitigate risk.

- Documentation: They handle the necessary documentation and compliance requirements associated with issuing the SBLC.

- Payment Processing: In the event of a default, the SBLC provider processes payment to the beneficiary as stipulated in the terms of the SBLC.

- Advisory Services: Many SBLC providers offer advisory services to help clients understand the implications and uses of SBLCs in their transactions.

Types of #SBLCProviders:

- Commercial Banks: Most common providers, offering a range of financial products.

- Investment Banks: May offer specialized SBLC services, especially for larger transactions.

- Trade Finance Companies: Focused on international trade, these companies often provide SBLCs as part of their services.

- Financial Services Providers (FSP): General Credit Finance and Development Limited (GCFDL) are premier provider of Business Loans, SME Loans, Collateral Transfer, Bank Financial Instruments, Standby Letters of Credit (SBLC) and Bank Guarantees (BG) with five decades of experience.

Since our incorporation in 1973, we’ve been the trusted choice for businesses across the globe, offering tailored financial solutions for viable projects worldwide and welcoming applicants from all cultures, and nationalities.

Choosing a #genuineSBLCprovider is crucial, as it impacts the reliability and acceptance of the SBLC in trade and financial transactions.

In summary, Standby Letters of Credit (SBLCs) offer a multitude of advantages for businesses. From enhancing credibility and mitigating risk to facilitating international trade and improving cash flow management, #SBLC can play a pivotal role in a company’s financial strategy. As businesses continue to navigate an ever-evolving economic landscape, incorporating #SBLCs into their offerings can not only strengthen their financial position but also foster long-term relationships with clients. Embracing this financial tool can pave the way for growth, stability, and success in the competitive world of business finance.

Frequently Asked Questions

How Does an SBLC Work in Practice?

An SBLC acts as a “standby” guarantee. If the applicant fails to meet contractual terms—such as paying for goods or completing a project—the beneficiary can claim the SBLC by presenting required documents to the issuing bank. These documents typically include a formal demand for payment and evidence of default. Once verified, the bank compensates the beneficiary up to the SBLC’s stated amount.

When Should Businesses Use an SBLC?

Businesses use SBLCs in a variety of scenarios, such as:

- International Trade: To protect both buyers and sellers from payment or delivery risks.

- Project Financing: To guarantee payments to contractors or subcontractors.

- Service Agreements: To back performance or delivery obligations in service contracts.

An SBLC provides the assurance needed to finalize high-stakes transactions confidently.

Key Benefits of an SBLC

- Trust Building: Strengthens relationships between business partners by offering financial assurance.

- Credit Enhancement: Improves the applicant’s credibility with counterparties.

- Global Applicability: Recognized worldwide under standardized rules, such as the Uniform Customs and Practice for Documentary Credits (UCP 600) or the International Standby Practices (ISP 98).

Types of SBLCs

There are two primary types of SBLCs:

- Performance SBLC: Ensures the completion of non-monetary obligations, such as timely project delivery or service fulfillment.

- Financial SBLC: Guarantees payment obligations, such as paying for goods or services.

The Process of Issuing an SBLC

To issue an SBLC, businesses need to:

- Submit a formal request to their bank.

- Provide a copy of the underlying contract or agreement.

- Share financial statements or evidence of creditworthiness.

- Specify the beneficiary’s details and the desired terms of the SBLC.

The issuing bank evaluates the applicant’s request and, if approved, provides the SBLC to the beneficiary.

Costs Associated with SBLCs

The cost of an SBLC varies based on factors like the bank’s fees, the applicant’s credit profile, and the SBLC amount. Common charges include:

- Issuance Fees: Typically 1-3% of the SBLC value per year.

- Processing Fees: One-time charges for documentation and administrative tasks.

- Amendment Fees: If any changes to the SBLC terms are requested.

Choosing a Trusted SBLC Provider & BG SBLC Monetizer

Not all financial providers are equal. The right SBLC provider ensures:

✅ Regulatory compliance (ICC URDG 758, SWIFT MT760).

✅ Fast processing (5-10 banking days).

✅ Competitive pricing with no hidden fees.

Why Trust General Credit Finance and Development Limited (GCFDL)?

At GCFDL, we provide:

🔹 SBLC & BG issuance for trade finance & project funding.

🔹 BG & SBLC monetization to unlock capital.

🔹 Global banking partnerships ensuring smooth transactions.

🚀 Secure your SBLC or Bank Guarantee today!

📩 Contact our trade finance experts now:

🌐 Website: www.gcfdl.com

📧 Email: info@gcfdl.com

[…] both a bank guarantee and a standby letter of credit involve the issuing bank accepting liability if the customer defaults, there are notable […]

[…] Carta de Crédito Standby (SBLC) se usa comúnmente en transacciones tanto internacionales como domésticas donde el comprador y el […]

[…] Banks in the U.S. generally do not issue bank guarantees. Instead, they provide standby letters of credit, which serve the same purpose by ensuring the beneficiary gets paid if the client cannot meet their obligations. It’s a similar safety net, just under a different name. […]

[…] are numerous benefits of SBLC to both parties involved in a transaction, providing a reliable safety net and facilitating […]

[…] standby letter of credit, abbreviated as SBLC, is a guarantee of payment by a bank on behalf of their client. It’s a […]

[…] to secure financing, activate credit lines, or facilitate international trade, our expertise in Bank Guarantees, Standby Letters of Credit, and BG/SBLC will enable you to close important deals, especially those in the import and export […]