Finding Trusted Sblc Provider & Bank Guarantee Monetizer

Finding Trusted Sblc Provider & Bank Guarantee Monetization

Did you know that 80% of global trade relies on financial instruments like Standby Letters of Credit (SBLCs) and Bank Guarantees (BGs)? Whether you’re an importer, exporter, investor, or contractor, having a trusted SBLC provider or BG SBLC monetization company can make or break your international deals.

In this guide, you’ll discover:

✅ What SBLCs and Bank Guarantees are and how they work.

✅ How to monetize BGs and SBLCs for business growth.

✅ Why choosing the right SBLC provider & BG SBLC monetizer matters.

What is an SBLC?

A standby letter of credit, abbreviated as SBLC, is a bank-issued guarantee ensuring payment if the buyer defaults.

An SBLC acts as a safety net for the payment of a shipment of physical goods or completed service to the seller, in the event something unforeseen prevents the buyer from making the scheduled payments to the seller. In such a case, the SBLC ensures the required payments are made to the seller after fulfillment of the required obligations.

SBLCs are widely used in:

- International trade & project finance

- Construction contracts & infrastructure deals

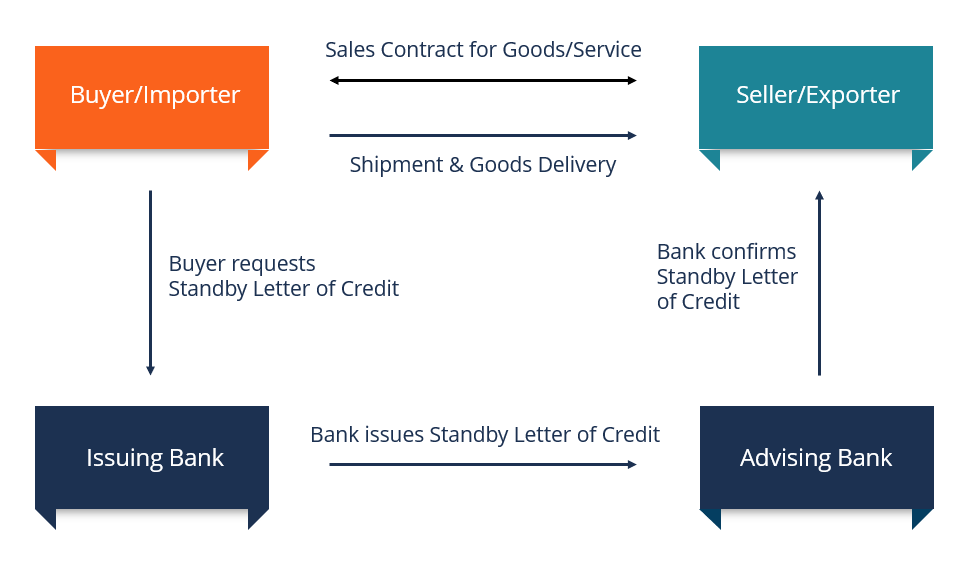

How an SBLC Works

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report. If the buyer’s creditworthiness is in question, the bank may require the buyer to provide an asset or the funds on deposit as collateral before approval.

The level of collateral will depend on the risk involved, the strength of the business, and the amount secured by the SBLC. The buyer will also be required to furnish the bank with information about the seller, shipping documents required for payment, the beneficiary’s bank, and the period when the SBLC is valid.

After review of the documentation, the commercial bank will provide an SBLC to the buyer. The bank will charge a service fee of 1% to 10% for each year when the financial instrument remains valid. If the buyer meets its obligations in the contract before the due date, the bank will terminate the SBLC without a further charge to the buyer.

If the buyer fails to meet the terms of the contract due to various reasons, such as bankruptcy, cash flow crunch, dishonesty, etc., the seller is required to present all the required documentation listed in the SBLC to the buyer’s bank within a specified period, and the bank will make the payment due to the seller’s bank.

Types of Standby Letters of Credit (SBLC)

There are two main types of Standby Letters of Credit, each serving different purposes:

- Performance SBLC: This type of SBLC ensures that non-financial contractual obligations are met. These obligations might include quality standards, delivery schedules, or other performance criteria. If the importer fails to meet these obligations, the bank will compensate the beneficiary, typically the exporter, for any losses incurred.

- Financial SBLC: This SBLC guarantees that financial obligations are fulfilled. It ensures that payment is made if the importer does not settle the payment for goods or services received. Financial SBLCs can also be issued in favor of the exporter’s bank, providing additional security in financial transactions.

💡 Example: A Dubai construction firm secures a $50M contract but needs financial security. They obtain an SBLC from a #trusted SBLC provider like General Credit Finance and Development Limited (GCFDL), reassuring the project owner and ensuring smooth execution.

SBLC vs. Other Letters of Credit

While an SBLC and a standard Letter of Credit both involve a bank’s promise to pay, they differ in their primary functions:

- Backup Plan: An SBLC is designed as a fallback mechanism, intended to be used only if the primary payment method fails. In contrast, a standard Letter of Credit is a primary payment tool, with the expectation that it will be used as part of the regular transaction process.

- Performance Component: SBLCs can include performance-related terms, ensuring that contractual obligations are met. This aspect is less common in standard Letters of Credit, which focus more on the payment process itself.

- Usage: SBLCs are frequently used in domestic transactions, such as construction projects or utility services. Standard Letters of Credit are more prevalent in international trade, where they help facilitate cross-border transactions.

Understanding Bank Guarantees (BGs) & Their Role in Global Trade

A bank guarantee is a financial backstop offered by a financial institution promising to cover a financial obligation if one party in a transaction fails to hold up their end of a contract. Generally used outside the United States, a bank guarantee enables the bank’s client to acquire goods, buy equipment, or perform international trade. If the client fails to settle a debt or deliver promised goods, the bank will cover it.

Key Takeaways

Different types of guarantees include a performance bond guarantee, an advance payment guarantee, a warrantee bond guarantee, and a rental guarantee.

A bank guarantee is a promise by a financial institution to meet the liabilities of a business or individual if they don’t fulfill their obligations in a contractual transaction.

Bank guarantees are largely used outside the U.S. and are similar to American standby letters of credit.

Bank guarantees are commonly used in:

✔ Real estate & investment projects

✔ Trade finance & infrastructure development

Types of Bank Guarantees:

Here are several kinds of bank guarantees that cover various risks, including:1

- Performance bond guarantee: Serves as collateral for the buyer’s costs if services or goods are not provided as agreed in the contract.

- Advance payment guarantee: Acts as collateral for reimbursing the buyer’s advance payment if the seller does not supply the specified goods per the contract.

- Warranty bond guarantee: Serves as collateral, ensuring ordered goods are delivered as agreed.

- Payment guarantee: Assures a seller the purchase price is paid on a set date.

- Rental guarantee: Serves as collateral for rental agreement payments.

For example, the World Bank offers a bank guarantee program for projects. These guarantees provide commercial lenders security against payment default or failure to meet performance obligations by governments.

💡 Case Study: A European machinery supplier secures a $10M deal with an African mining firm. The buyer demands financial assurance, so the supplier obtains a BG from a #trusted bank guarantee provider like General Credit Finance and Development Limited (GCFDL), ensuring smooth trade execution.

Key Differences Between Standby Letter of Credit vs. Bank Guarantee

Standby Letters of Credit (SBLCs) and Bank Guarantees are two essential financial instruments used to secure transactions and mitigate risks. While they share similarities in function, their applications and underlying mechanisms differ.

Key Differences

1. Usage and Common Practice:

- Bank Guarantee: BGs are often used in various commercial transactions, including construction contracts, performance bonds, and tender guarantees. They are commonly employed in situations where a party needs to assure the other party that contractual obligations will be met. For example, in a construction contract, a contractor might provide a BG to the project owner to ensure that the project will be completed as agreed.

- SBLC: SBLCs are predominantly used in international trade and financial transactions as a backup to ensure payment in case the buyer or applicant fails to fulfill their payment obligations. They are particularly useful in situations involving large transactions where trust between parties is limited. For instance, an SBLC might be used to secure a large shipment of goods, ensuring that the supplier will be paid even if the buyer defaults.

2. Nature of the Commitment:

- Bank Guarantee: The commitment under a BG is usually contingent on the occurrence of an event specified in the guarantee. It is often linked to a specific contract or performance-related requirement. The BG typically does not require the presentation of documents for payment; instead, the bank pays based on the underlying default or non-performance of the principal.

- SBLC: The SBLC is a documentary credit, meaning that payment is generally made only when the beneficiary presents the required documents as stipulated in the SBLC terms. These documents typically include evidence of default or non-performance. The SBLC follows the documentary credit principles of international trade, such as the Uniform Customs and Practice for Documentary Credits (UCP 600) or the International Standby Practices (ISP 98).

3. Document Presentation:

- Bank Guarantee: In the case of a BG, the process of claiming payment is relatively straightforward. The beneficiary may need to provide proof of default or non-performance, but it does not usually involve presenting specific documents to the bank.

- SBLC: The SBLC requires the presentation of specific documents that demonstrate the default or non-performance of the applicant. These documents might include invoices, shipping documents, or other evidence as defined in the SBLC terms. This requirement makes the SBLC more aligned with international trade practices.

4. Legal Framework and Regulation:

- Bank Guarantee: BGs are typically governed by the laws of the country where they are issued and can vary significantly in terms of legal interpretation and enforcement. The specifics of BGs might be influenced by local regulations and practices.

- SBLC: SBLCs are more standardized and are governed by international rules such as the ISP 98 or the UCP 600. These frameworks provide a consistent legal and procedural basis for SBLCs, particularly in international transactions, which helps in reducing ambiguity and disputes.

5. Financial Implications:

- Bank Guarantee: The cost of a BG is generally lower compared to an SBLC. BGs might require a one-time fee or a percentage of the guaranteed amount, depending on the bank’s policies and the nature of the guarantee.

- SBLC: SBLCs often come with higher fees due to the documentary requirements and the complexity of the process. Banks charge for the issuance, amendment, and confirmation of SBLCs, which can make them more expensive than BGs.

Monetizing SBLC & BG: Turning Guarantees into Capital

Did you know that you can convert your SBLC or BG into cash? BG SBLC monetization allows businesses to unlock liquidity for:

📌 Project financing

📌 Trade expansion

📌 Securing additional financial instruments

How Monetization Works:

1️⃣ A company secures an SBLC or BG from a financial institution.

2️⃣ The instrument is assigned to a monetizer in exchange for funds.

3️⃣ The funds can be used for business expansion & trade financing.

Choosing a Trusted SBLC Provider & BG SBLC Monetizer

Not all financial providers are equal. The right SBLC provider ensures:

✅ Regulatory compliance (ICC URDG 758, SWIFT MT760).

✅ Fast processing (5-10 banking days).

✅ Competitive pricing with no hidden fees.

Why Trust General Credit Finance and Development Limited (GCFDL)?

At GCFDL, we provide:

🔹 SBLC & BG issuance for trade finance & project funding.

🔹 BG & SBLC monetization to unlock capital.

🔹 Global banking partnerships ensuring smooth transactions.

🚀 Secure your SBLC or Bank Guarantee today!

📩 Contact our trade finance experts now:

🌐 Website: www.gcfdl.com

📧 Email: info@gcfdl.com